Talking Points:

Donchian creates a channel that encapsulates price.

Trade entries can be made when Donchian is broken.

Stop losses can be created from the opposing channel line.

I’ve written quite a bit about the importance of support and resistance levels for trade entries and trade exits. They play an integral part in optimizing any strategy’s trading rules. There are many ways to manually create support and resistance lines on our trading charts, but if you are like me, it is always nice to find an easier and simpler way to perform the same task. In today’s article, we take a look at the Donchian Channel, a tool that can help identify support and resistance and directly assist in placing trade entries and exits.

Sign up for my email list to receive my latest articles and videos.

How Does the Donchian Channel Work?

The Donchian Channel is an indicator built into FXCM’s Trading Station platform. It consists of two lines that are drawn at the highest and lowest prices for a specified period of time. The image below shows the Donchian Channel on an hourly chart set to a period size of 24 candles. The Upper line displays the highest price achieved in the last 24 hours and the Lower line displays the lowest price achieved in the last 24 hours.

Learn Forex: Donchian Channel – Upper and Lower Lines

(Created using Marketscope 2.0 charting package)

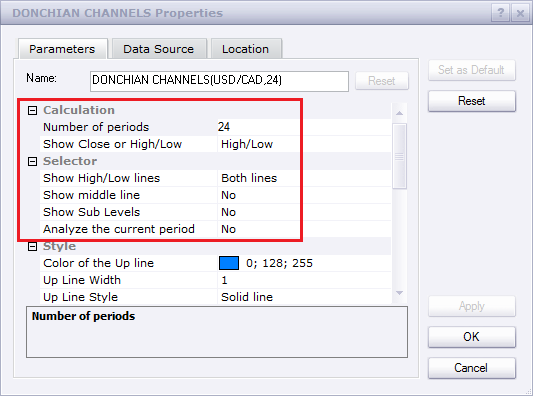

These lines can act as support or resistance when price comes into contact with them. The rationale is that price has already bounced off of those levels once before (when it made the previous high or low) and could bounce off those levels again in the future. I have posted my favorite settings below since they are a little bit different than the default settings.

Learn Forex: Donchian Channel Settings

Trade Entries Using Donchian Channel

The best part of this indicator is how easily it can generate actual trades. Anytime price breaks above the Upper Donchian, that is a buy signal. And anytime price breaks below the Lower Donchian, that is a sell signal. The chart below shows an example of signals that are generated using Donchian. As you can see, there are a lot of signals.

Learn Forex: Donchian Channel – Buy and Sell Signals

(Created using Marketscope 2.0 charting package)

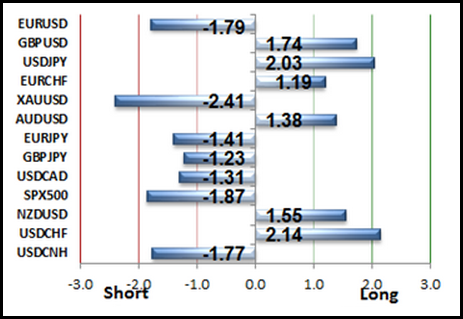

One way to reduce the number of actionable signals we receive, is to use a direction filter alongside the Donchian Channel. My favorite direction filter is the Speculative Sentiment Index or SSI. This will limit our trading to a single direction. To learn how to use SSI, click here. The image below shows the most recent reading for SSI.

Learn Forex: Speculative Sentiment Index – DailyFX Plus

(Created using DailyFX’s SSI – Free Trial)

We would look for buying opportunities only on currency pairs where the SSI was negative and look for selling opportunities on currency pairs where the SSI was positive. However, this will still result in an excessive number of entry signals. So another other way we can reduce the amount of signals we trade is to only allow ourselves to have one trade open at a time. So once we are in a trade, we would not add more trades to our account until the first trade was closed out.

Trade Exits Using Donchian Channel

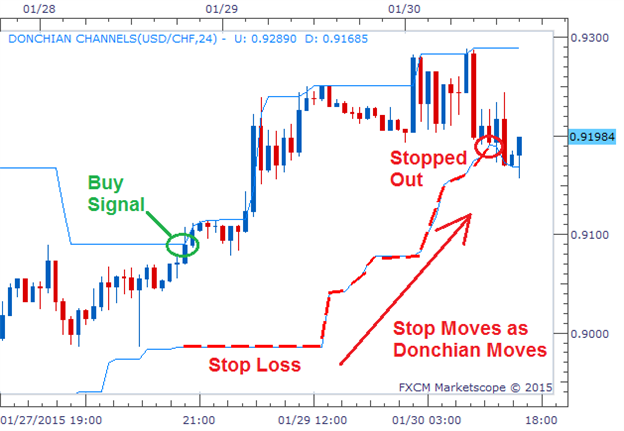

Lastly we can use the Donchian Channel to create or exit strategy by setting our stop loss on the Donchian line opposite of our trade entry. So if we were to sell on the break of the lower Donchian, we would set a stop loss to buy at the upper Donchian. And if we were to buy on the break of the upper Donchian, we would set a stop loss to sell at the lower Donchian (like in the image below).

Learn Forex: Buy Signal with Donchian Channel Stop Loss

Of course, this only manages one outcome of a trade, the losing side. So how can we manage a position if it’s a winner? Well, we use the same Donchian line, but we trail our stop as the Donchian line moves in our favor. This gives us a more intelligent type of trailing stop.

Learn Forex: Intelligent “Trailing” Stop Using Donchian Channel

The image above shows a buy signal with a stop loss placed on the opposite side of the Donchian Channel. As the lower Donchian line moves higher, we can move our stop loss higher as well. This eventually leads to a profitable trade.

With this type of money management, we combine limitless profit potential with the ability to calculate our potential loss on the trade. We are likely to have a greater number of losing trades than winners using this strategy, but a handful of the winners should be substantially larger than the average loser in terms of pips.

In Conclusion

Donchian Channel can be a great way to automatically locate support and resistance as well as generate trade entry and trade exit levels. To test this tool, feel free to paper trade these positions on aFree Forex Demo accountto practice trading currencies risk-free.

Good trading!

—Written by Rob Pasche (@RobPasche)

To contact Rob, email rpasche@dailyfx.com.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)

Money Management Principles (31:44)

Trade Like a Professional Workshop (1:44:14)

2-for-1 Indicator, the Donchian Channel

No comments:

Post a Comment