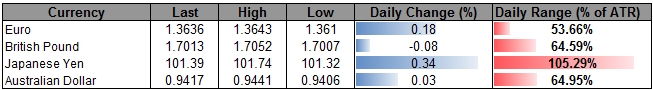

Talking Points:

- USDOLLAR Slips to Fresh Monthly Low; Bearish Setup Remain Intact Ahead of NFP

- USD/JPY Extends Decline as Bearish RSI Break Takes Shape

- EUR/AUD in Focus Ahead of RBA & ECB Policy Meetings

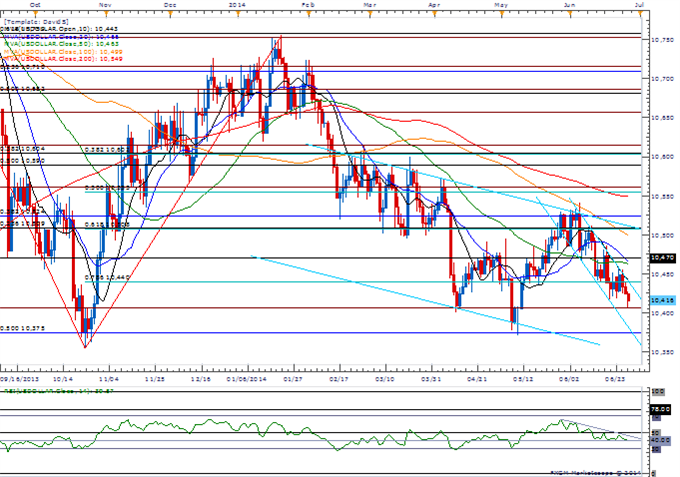

USDOLLAR(Ticker: USDollar):

Dow Jones-FXCM U.S. Dollar Index remains at risk for lower-highs & lower-lows in July as price and the Relative Strength Index (RSI) retain the bearish trends.

Still waiting & watching for the RSI to break below 40 to favor a further decline.

Even though Non-Farm Payrolls (NFP) are projected to increase 210K in June, the May (10,370) & October (10,354) lows remain the next key levels of interest as the Fed retains its current approach for monetary policy.

USD/JPY:

Slips to fresh monthly low of 101.30; close below 200-Day SMA (101.63) would be the first since October 2013.

Keeping a close eye on the RSI as it appears to be breaking down from the bullish trend from earlier this year.

Next key level of interest comes in at 101.00 (50.0% Fibonacci retracement from October advance).

EUR/AUD

Appears to have carved a series of lower-highs in June as pair retains bearish RSI momentum.

20-Day SMA (1.4506) lining up very nicely with near-term trendline resistance; favors looking for opportunities to ‘sell bounces’

Reserve Bank of Australia widely expected to retain its current policy, while European Central Bank (ECB) may sound increasingly dovish as they continue to implement non-standard measures.

For more updates, sign up for David’s e-mail distribution list.

Join DailyFX on Demandfor Real-Time SSI Updates Across the Majors!

Read More:

AUDCHF Rebounds Off Key Support- Longs Favored Above 8360

USDOLLAR Daily

Chart – Created Using FXCM Marketscope 2.0

Interim Resistance: 10,602 (38.2 retracement) to 10,615 (78.6 expansion)

Interim Support: 10,354 to 10,375 (50.0 retracement)

Click Here for the DailyFX Calendar

— Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

USD/JPY Risks Further Declines Amid Deviation in BoJ & Fed Policy

No comments:

Post a Comment