Talking Points

USD/JPY Technical Strategy: Longs Preferred

Clearance Of Key Hurdles Casts Spotlight Higher

Next Definitive Level Offers Significant Upside Scope

USD/JPY’s astounding vertical ascent has left a lack of reversal signals in its path, suggesting the potential for further gains. The next definitive peak to offer a potential resistance region rests near 114.60, the December 2007 high. However, traders should also be wary of the recent weekend gap, given the tendency of such spaces to be filled which may prove a temporary setback. A daily close below the 110.00 barrier would be required to negate a bullish bias.

USD/JPY: Climbs Over Key Hurdles Amid A Void Of Bearish Patterns

Daily Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

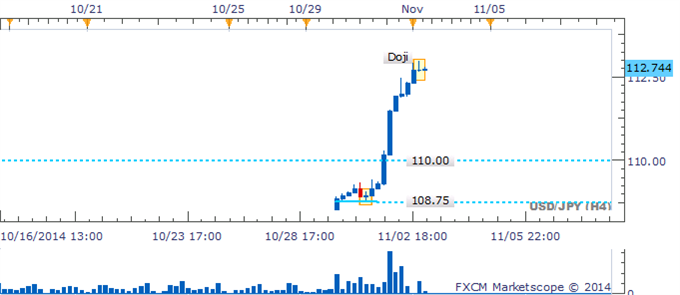

A Doji on the four hour chart suggests the bulls may be showing signs of tiring. Yet key bearish reversal signals remain lacking, casting doubt on a corrective pullback.

USD/JPY: Void Of Bearish Signals In Intraday Trade

Four Hour Chart – Created Using FXCM Marketscope 2.0,Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @DaviddeFe

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

USD/JPY Vertical Climb Leaves Lack Of Reversal Patterns In Its Wake

No comments:

Post a Comment