Talking Points

Persistent weakness in metal warns period of general USD strength nearing

USD/JPY volatility compression points to looming trend move

USD/CAD turns at key Fibonacci level

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

Foreign Exchange Price & Time at a Glance:

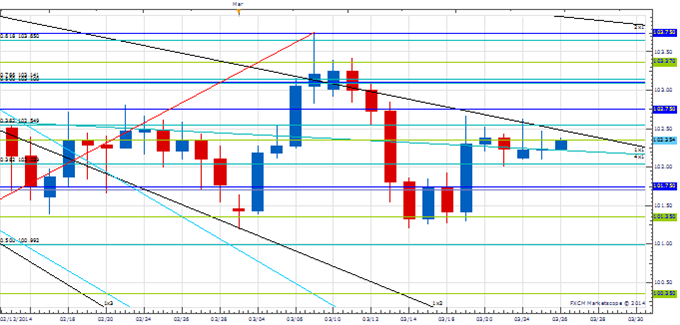

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/JPY continues to meander around the 3rd square root relationship of the year’s high at 102.35

Our near-term trend bias is higher in the exchange rate while over 101.35

The 1×1 Gann angle line of the year’s high near 102.50 is immediate resistance, but a move through the 2nd square root relationship of the year’s low at 102.75 is needed to re-instill positive momentum

A minor cycle turn window is seen today

A move under 101.35 would turn us immediately negative on USD/JPY

USD/JPY Strategy: We like the long side while over 101.35.

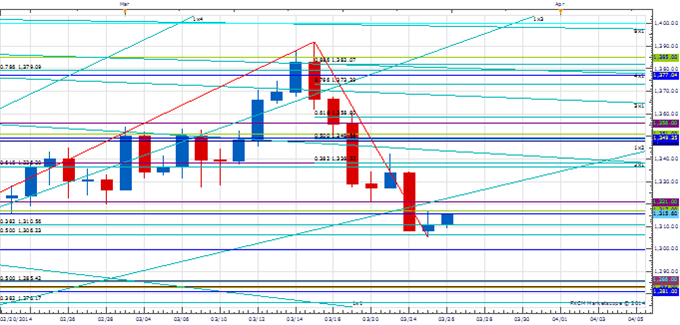

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/CAD reversed last week from the 200% extension of the 2H12 range in the 1.1260 area

Our near-term trend remains higher in Funds while over the 2nd square root relationship of the year’s high at 1.1065

Immediate resistance is seen at 1.1170, but a move through 1.1260 is really required to signal a resumption of the broader uptrend

A very minor cycle turn window is seen tomorrow

A daily close under 1.1065 would turn us negative on Funds

USD/CAD Strategy: We like the long side while over 1.1065.

Focus Chart of the Day: GOLD

Gold has come under steady pressure since recording a high just shy of 1392 during a key cycle turn window (8.6 months from 1H13 low) last week. The ease at which the metal broke through the 2nd square root relationship of the YTD high at 1318 on Monday keeps focus lower with the 50% retracement of the December/March range at 1285 now at risk. With an important cycle turn window for USD expected later in the week we can help but wonder if the general weakness being exhibited in the metal is a leading indicator for a period of general dollar strength against the currencies in the weeks ahead? The price action over the next days should answer this question. As for Gold, the next important metal specific cycle turn window is seen around April 4-9. Only unexpected aggressive strength above 1360 would signal the uptrend has resumed ahead of schedule.

To receive Kristian’s analysis directly via email, pleaseSIGN UP HERE.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Price & Time: Gold Leading the Way for Currencies?

No comments:

Post a Comment