Fundamental Forecast for Dollar:Bullish

The transition into the second quarter can expose risk trends and investors’ bubbling fears

NFPs may be less effective to bolstering the dollar than the ECB decision, Japanese tax hike and Chinese data

Have an opinion on the US Dollar? Trade it via Currency Trading Baskets

Over the past weeks, the dollar has generated little strength from its safe haven status while its yield buoyancy following the FOMC’s third Taper lost traction. In periods of complacency and moderation, the greenback is at risk of retracing event-driven short-term gains – just like volatility has quickly deflated swell after swell. But through this oscillation, the currency has refused a full bear shift. Resilience through unfavorable conditions is an inherently bullish reflection. But what happens when the tides turn and the fundamentals start to supply outright support? In the week ahead, we will see the dollar’s rate outlook leveraged by March NFPs and speculation surrounding its counterparts’ policy bearings. Furthermore, the specter of a risk collapse should keep greenback traders at the ready.

While there is a more material probability to see the dollar’s activity level and direction change via a shift in monetary policy expectations, the impact of a market-wide shift in risk appetite would carry far more weight. Probability versus potential. Speculative appetites are not attuned to ‘optimism’ now. They are fully set into complacency and a scramble to make a benchmark-beating return at any cost. Anecdotally, the bulls that have trumpeted the market’s climb to record highs are second guessing the foundation under the capital market’s current highest and are questioning what could make it project further. A view of investing in value, growth, earnings and yields contradicts the fundamental backdrop and current market highs.

An effort to bid any dip in mature trends from the likes of US equities has been the primary means of gains for bulls so far this year, and the limitations of that strategy are growing more and more obvious. A shift in sentiment will quickly reveal the level of exposure market participants have taken (record leverage, exceptionally low participation, positioning in low yielding but historically high-risk assets) and encourage deleveraging. Yet, the question has long been: what will set the blaze? In the week ahead, we have the rollover in the quarter. On April 1, we move into the second quarter. The periodical transitions are important in the financial world as this is an opportunity for many passive capital market participants – retirement accounts, governmental funds, etc – to make changes for another full quarter’s holding period. Are investors really that confidence? We will see.

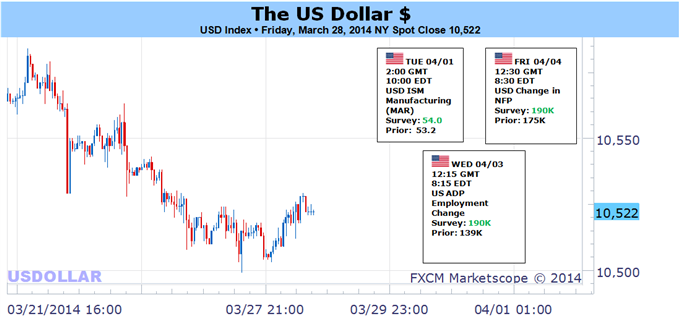

There are plenty of other calendar items throughout the week that can stir sentiment, but the spark will likely be just that: a spark. A purposeful shift in sentiment will materialize through underlying conditions that have steadily developed over time. But, it is that catalyst that breaks the trance of hope that remains elusive. Ahead, we have Friday’s March NFPs, a speech from Fed Chair Janet Yellen, trade figures, and manufacturing and service sector activity readings. All of these are individually important, but their greatest role would come as the inspiration to touch off a deeper misgiving amongst speculators.

This round of data will also feed interest rate speculation behind the dollar. Despite a third Taper and a better timeline for hikes delivered with the FOMC’s meeting on March 19, we have seen the greenback’s yield advantage ease in the FX market this past week. Yet, looking at the Treasury yield curve; we find rate expectations building. The disconnect is that we are dealing with a relative market. If EU, UK and other regions’ rates are building more aggressively, the dollar still loses ground.

For the dollar to perform via its monetary policy bearings, the most reliable scenario would be a broad drop in global financial and economic optimism what would immediately pressure the likes of the ECB, BoJ and BoE to ease back on hawkish moves and maybe even spur more stimulus. In that situation, the Fed’s vow that the threshold to change Taper is high would act as a prow to market corrections. Otherwise, an ECB decision, Chinese growth readings and the BoJ’s tax hike are all indirect highlights for the USDollar. – JK

US Dollar Prepares for Impact of NFPs Release, S&P 500 Breakout

No comments:

Post a Comment