Talking Points

Major “time resistance” this week in USD/JPY

Important turn window coming up in the euro

Kiwi closing in on key support level

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

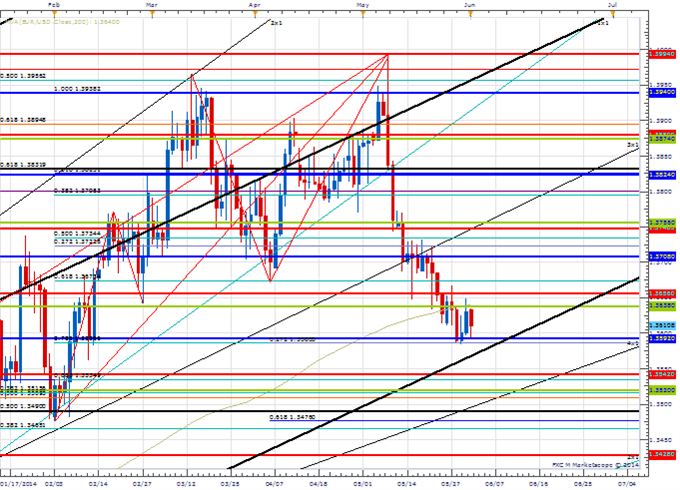

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD has been under steady pressure since peaking out at the 11th square root relatuionship of the 2013 low near 1.3995 early last month

Our bias is lower in the euro while below 1.3675

The 127% extension April/May advance at 1.3590 is interim support ahead of major attractions at 1.3540 and 1.3520

A fairly important cycle turn window is eyed this week

A move through 1.3675 would turn our immediate attention higher in the exchange rate

EUR/USD Strategy: We like sharply reducing short positions in the euro over the next few days.

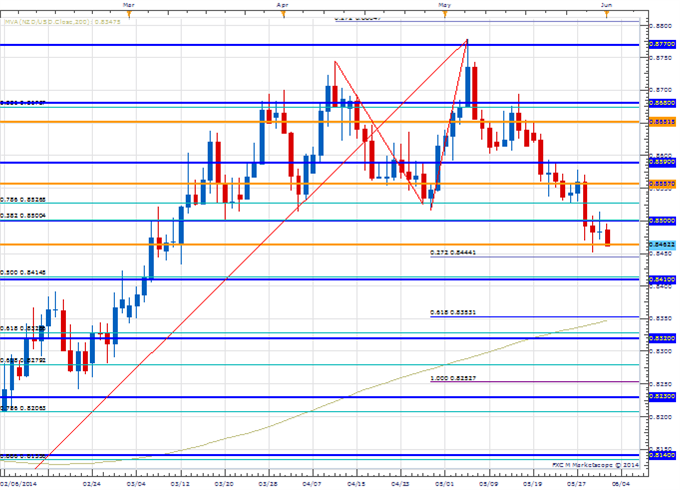

Price & Time Analysis: NZD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

NZD/USD has moved steadily lower since failing at the 8th square root relationship of the year’s low in early May

Our near-term trend bias is lower in the Kiwi while below .8515

Interim support is seen around .8445 ahead of an important potential reaction zone just ahead of .8400

A cycle turn window is seen here in the exchange rate

A move back through .8515 would shift immediate attention higher in the Bird

NZD/USD Strategy: Like covering short Kiwi positions over next day or so. May look to go long above .8515.

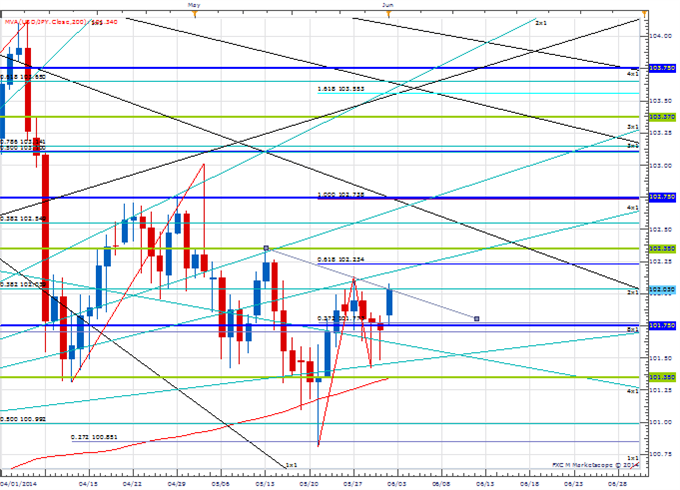

Focus Chart of the Day: USD/JPY

USD/JPY has the markets excited once again. A potential inverse head & shoulders pattern on the daily chart above the 200-day moving average (101.35) has many traders looking for a repeat of last October when the exchange rate briefly undercut the moving average before exploding to new multi-year highs by January. While we see similarities with last year we also see many differences which is making us skeptical that any sort of meaningful advance will start here. The biggest headwind we see is that the cyclical backdrop is not nearly as favorable this time around in the exchange rate. A “Pi cycle” turn window related to the 2011 low looks particularly ominous and should influence this week. With the exchange rate rallying into the window a high is favored. We would be surprised if it did not prompt a decline lasting at least a couple weeks. Critical resistance is seen between 102.70 and 103.15. Only traction above this zone would undermine our broader negative view and set up a more important push higher in the weeks ahead. A daily close below 101.35 should confirm that a more serious decline is underway.

To receive Kristian’s analysis directly via email, pleaseSIGN UP HERE.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Price & Time: Keep A Close Eye on USD/JPY This Week

No comments:

Post a Comment