Talking Points:

-Why Moving Averages Are Popular

-Who Uses Moving Averages

-How You Can Use the Popular Moving Averages

Make everything as simple as possible, but not simpler.

-Albert Einstein

After many years of trading, you’ll be hard pressed to find an indicator as simple or effective as moving averages. Moving averages take a fixed set of data and give you an average price. If the average is moving higher, price is in an uptrend on at least one or possibly multiple time-frames.

Why Moving Averages Are Popular

Presented by FXCM’s Marketscope Charts

Moving averages are simple to use and can be effective in recognizing trending, ranging, or corrective environments so that you can be better positioned for the next move. Often traders will use more than one moving average because two moving averages can be treated as a trend trigger. In other words, when the shorter moving average crosses above the slower moving average, like in the finger trap strategy, a buy signal is generated until the moving averages reverse or you hit your profit target.

One word of warning: it’s best to stick to a few specific moving averages. This will prevent you from trying to find the “perfect moving average” and rather keep you objective as to whether the trend is starting, accelerating, or slowing down.

The moving averages I often use are the 8, 21, 55 for trade triggers and a 100 or 200 for a clean trend filter. These moving averages are often used by investment banks however the 100 & 200 are the most widely used. The shorter moving average will depend on your preference and how many signals you’re looking to trade.

Who Uses Moving Averages

Moving Averages are often the first indicator that new traders are introduced to and for good reason. It helps you to define the trend and potential entries in the direction of the trend. However, moving averages are also utilized by fund managers & investment banks in their analysis to see if a market is nearing support or resistance or potentially reversing after a significant period.

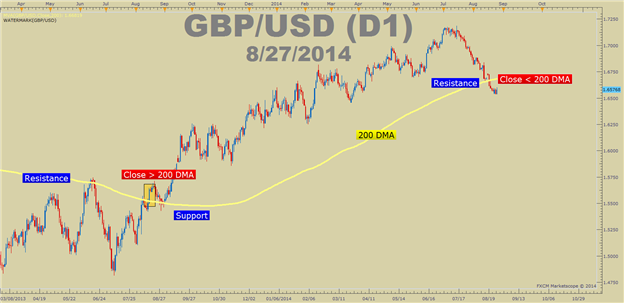

GBPUSD Traded Above the 200 DMA for 261 Days Showing Exhaustion

Presented by FXCM’s Marketscope Charts

Moving averages can be a simple tool to define support and resistance in the FX Market. When a market is in a strong trend, any bounce off a moving average, like the first bounce off the 200-dma in the GBPUSD chart above, can present a significant opportunity to join the trend until price closes below the 200-dma. However, if price continues to move above and below the moving average in a short period of time, you’re likely in a range and those reversals are lest significant from a trading point of view.

You can register for a free online course on Moving Averages here.

How You Can Use the Popular Moving Averages

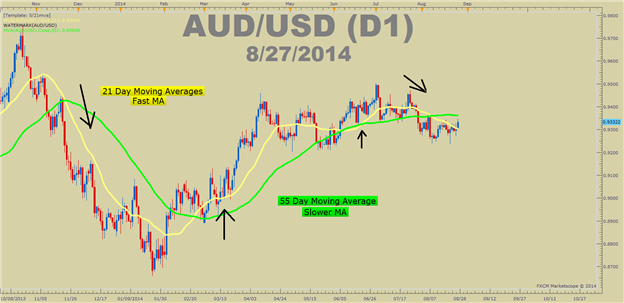

There are many uses for moving averages but a simple system is to look for a moving average cross over. The moving average crossover looks for the short or faster moving average to cross above an already rising longer or slow moving average as a buy signal. When looking to sell a currency pair, you can look for the short or faster moving average to cross below a falling longer or slow moving average as a sell signal.

AUDUSD Has Shown Clean Moves Around the 21 & 55-dma

Presented by FXCM’s Marketscope Charts

When looking to use moving averages, you’re ability to control downside risk will determine your success. It’s important to know that markets that were once trending, with very clean moving average signals, to a range with more noise than signals. If you can get comfortable with a specific set of moving averages, you can objectively analyze and trade the FX market week in and week out.

Happy Trading!

—Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@dailyfx.com

To be added to Tyler’s e-mail distribution list, please click here

Tyler is available on Twitter @ForexYell

Add me to your Google+ Forex Circle

A Simple Guide for Using the Popular Moving Averages in Forex

No comments:

Post a Comment