Talking Points

USD/JPY Technical Strategy: Sidelines Preferred

Daily Close Below 104.00 Suggests A ‘False Breakout’

Parade of Dojis Highlight Indecision Amongst Traders

USD/JPY remains in a vulnerable position after closing below the 104.00 barrier amongst signs of hesitation amongst traders denoted by a Dojicandlestick. This could leave the pair primed for a push towards the 103.00 floor. However the prospect of a more severe correction is questionable in the absence of classic bearish reversal signals.

USD/JPY: Daily Close Confirms ‘False Breakout’

Daily Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

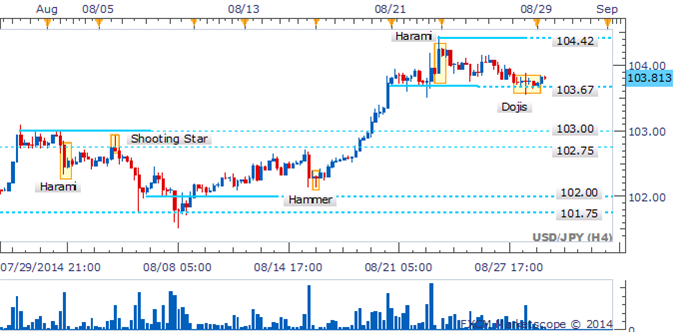

A narrow trading band and parade of Dojis on the four hour chart is indicative of indecision amongst traders. This suggests awaiting a more constructive set of signals before entering new positions may be prudent.

USD/JPY: Dojis Indicate Indecision As Trading Band Emerges

Four Hour Chart – Created Using FXCM Marketscope 2.0,Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

USD/JPY Ensemble of Dojis Highlights Hesitation From Traders

No comments:

Post a Comment