Tuesday, March 31, 2015

HKD Falls Despite February?s Optimistic Retail Sales Figures

Talking Points:

• Hong Kong Retail Sales Increase.

• HKD Falls Against the USD Following Retail Sales Announcement.

The HKD Fell as Hong Kong retail sales value year-on-year (YoY) increased dramatically in February 2015, coming in at 14.9 percent, ahead of leading economists’ expectations of -4.5 percent, and well above the previous period’s revised reading of -14.5 percent, according to the Census and Statistics Department of Hong Kong. Despite February 2015’s optimistic news, for the first two months of 2015 taken together, total retail sales decreased by 2.0 percent in value compared to the same two month period in 2014. Following netting out the effect of price changes over the same period, the volume of total retail sales in February increased by 18.2 percent, soaring past leading analysts’ predictions of 2.4 percent as well as the previous period’s figure of -13.9 percent. Again when taken together, retail sales in the first two months of 2015 decreased by 0.3 percent in volume when compared to the same two month period in 2014.

When comparing the combined total sales for January 2015 and February 2015 with the same two month period of 2014, the value of sales of commodities in supermarkets increased by 3.7 percent with the sales of medicines and cosmetics increasing by 8.3 percent. Food, alcoholic drinks and tobacco increased by 15.3 percent, with electrical goods and photographic equipment rising by 12.7 percent. When interpreting these figures, it should be noted that retail sales tend to show increased volatility before and after the Chinese Lunar New Year, and due to the current positioning of this year’s Lunar New Year’s date in February, it makes more statistical sense to combine both month’s retail sales figures.

HKD Falls Despite February?s Optimistic Retail Sales Figures

Euro Logs Massive Drop on Tuesday

The euro demonstrated massive losses on Tuesday with not-so-good economic data, the continuing problems in Greece and the economic stimulus from the European Central Bank. The shared 19-nation currency was set to have its worst quarter in the history.

The euro demonstrated massive losses on Tuesday with not-so-good economic data, the continuing problems in Greece and the economic stimulus from the European Central Bank. The shared 19-nation currency was set to have its worst quarter in the history.

The reasons for the euro’s drop were largely the same as yesterday — the debt woes of Greece and the quantitative easing program of the ECB. Unlike the previous session though, the euro sank against all its rivals, not just the dollar, during the current trading session.

As for macroeconomic indicators, they were not actually that bad though not good either strictly speaking. Eurostat reported that the eurozone remained in deflation in March, but the rate of the prices’ decline slowed. The eurozone unemployment rate was at 11.3 percent in February, slightly above the analysts’ projections, but it was still the lowest level since May 2012. The unemployment rate for the whole European Union was at 9.8 percent — the lowest since September 2011.

EUR/USD dropped from 1.0832 to 1.0736 as of 22:04 GMT today. EUR/GBP tumbled from 0.7315 to 0.7241. EUR/JPY dipped from 130.10 to 128.86.

If you have any questions, comments or opinions regarding the Euro,

feel free to post them using the commentary form below.

Euro Logs Massive Drop on Tuesday

China HSBC PMI revised higher in March

<!–TITOL:

China HSBC PMI revised higher in March

FITITOL–>

FXStreet (Bali) – China HSBC Manufacturing PMI was revised higher to 49.6 in March vs 49.2 flash and previous 50.7.

Comments by Annabel Fiddes, Economist at Markit

“The HSBC China Manufacturing PMI fell back below the neutral 50.0 mark at 49.6 in March, as the sector continues to struggle to gain growth traction.”

“The latest data indicate that domestic and foreign demand remains subdued amid weaker market conditions, which dampened output growth as a result.”

“Meanwhile, company downsizing policies contributed to a further decline in manufacturing employment, with the pace of job shedding the strongest since last summer.”

“Despite the sustained fall in cost burdens, any savings were generally passed on to clients as part of attempts to attract new business, suggesting a further squeeze on profit margins.”

China HSBC PMI revised higher in March

China HSBC Manufacturing PMI down to 49.6 in March from previous 50.7

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

©2015 “FXStreet. The Forex Market” All Rights Reserved.

China HSBC Manufacturing PMI down to 49.6 in March from previous 50.7

Japan Nomura/ JMMA Manufacturing Purchasing Manager Index came in at 50.3 below forecasts (50.4) in March

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

©2015 “FXStreet. The Forex Market” All Rights Reserved.

Japan Nomura/ JMMA Manufacturing Purchasing Manager Index came in at 50.3 below forecasts (50.4) in March

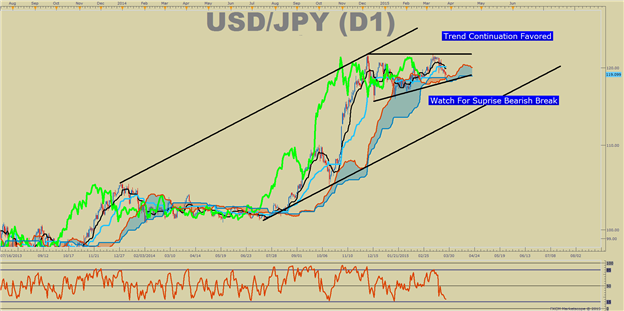

USD/JPY selling-off as risk mood sinks

<!–TITOL:

USD/JPY selling-off as risk mood sinks

FITITOL–>

FXStreet (Bali) – USD/JPY has sold off quite sharply in a matter of minutes, setting its lowest for the day at 119.40, after failing to hold above the 120.00 round umber during last Tuesday’s session.

The big miss in the Japanese Tankan series/capex saw an immediate downward response in Japanese stocks, with the Nikkei currently down 1.17%, and SP 500 futures also heavy, down over 1%, although volume at this time is reported very poor.

One of the potential catalysts for the sour mood in Asia today could also be the risk of a no nuclear deal with Iran. As Bloomberg reports, “world powers warned Iran that they’re ready to quit nuclear talks on Wednesday even if there’s no agreement, according to a participant, as the approach of a deadline led to brinkmanship on both sides.”

Bloomberg adds: “While negotiators have agreed to continue past midnight, breaking with the official timetable, the talks won’t be extended beyond April 1, said a diplomat from one of the six countries negotiating with Iran, speaking on condition of not being identified in line with protocol. The European foreign ministers intend to leave the Swiss city of Lausanne on Wednesday morning regardless of the outcome, the diplomat said.”

USD/JPY selling-off as risk mood sinks

AUD/USD picks up bullish momentum after upbeat Chinese PMI

<!–TITOL:

AUD/USD picks up bullish momentum after upbeat Chinese PMI

FITITOL–>

FXStreet (Bali) – AUD/USD is trading with a bid tone during Asia, with the last pop to the upside, worth over 25/30 pips coming on the back of a better-than-expected Chinese Manufacturing PMI in March (50.1 act vs 49.7 exp).

The latest print so far has seen the pair exchange hands at 0.7650, with Jim Langlands, Founder at FXCharts, noting that the surprise in the Chinese data may add some minor fuel for a run towards 0.7665.

However, the Australian-based Analyst adds: “I don’t think we head above here (7665) today, but if wrong, then 0.7700 and possibly to the Fibo resistance at 0.7725 (38.2% of 0.7937/0.7590) would come into view.”

AUD/USD picks up bullish momentum after upbeat Chinese PMI

Australia Feb Building Approvals* Decrease to -3.2 % (fcast -4.0 %) Vs Prev 7.9 %

Exclusive newsline by InstaForex is your reliable assistant in the Forex world.

Top Forex analysts with immense experience in Forex trading, dozens of comprehensive analytical reviews daily, various subjects and types of analysis. Moreover, economic calendar by InstaForex Company can help you be in the middle of informational flow.

Australia Feb Building Approvals* Decrease to -3.2 % (fcast -4.0 %) Vs Prev 7.9 %

Australia Feb Private House Approvals* Decrease to -0.1 % Vs Prev 0.4 %

Exclusive newsline by InstaForex is your reliable assistant in the Forex world.

Top Forex analysts with immense experience in Forex trading, dozens of comprehensive analytical reviews daily, various subjects and types of analysis. Moreover, economic calendar by InstaForex Company can help you be in the middle of informational flow.

Australia Feb Private House Approvals* Decrease to -0.1 % Vs Prev 0.4 %

Investors in Mexico are Cautiously Optimistic

Exclusive newsline by InstaForex is your reliable assistant in the Forex world.

Top Forex analysts with immense experience in Forex trading, dozens of comprehensive analytical reviews daily, various subjects and types of analysis. Moreover, economic calendar by InstaForex Company can help you be in the middle of informational flow.

Investors in Mexico are Cautiously Optimistic

Boj Official: Tankan Indexes Show Big Manufacturers, Non-Manufacturers See Labour Market Conditions at Tightest Levels Since

Exclusive newsline by InstaForex is your reliable assistant in the Forex world.

Top Forex analysts with immense experience in Forex trading, dozens of comprehensive analytical reviews daily, various subjects and types of analysis. Moreover, economic calendar by InstaForex Company can help you be in the middle of informational flow.

Boj Official: Tankan Indexes Show Big Manufacturers, Non-Manufacturers See Labour Market Conditions at Tightest Levels Since

Boj Official: Tankan Indexes Show Small Manufacturers, Non-Manufacturers See Labour Market Conditions at Tightest Levels

Exclusive newsline by InstaForex is your reliable assistant in the Forex world.

Top Forex analysts with immense experience in Forex trading, dozens of comprehensive analytical reviews daily, various subjects and types of analysis. Moreover, economic calendar by InstaForex Company can help you be in the middle of informational flow.

Boj Official: Tankan Indexes Show Small Manufacturers, Non-Manufacturers See Labour Market Conditions at Tightest Levels

EUR/NZD analysis for March 31, 2015

Overview:

In our last analysis, EUR/NZD was trading downwards. The price has tested the level of 1.4307 in an average volume. The price found support around the level of 1.4330 (our Fibonacci expansion 61.8%). The short-term trend is still neutral. So, be careful when trading EUR/NZD. According to price action on 4H time frame, we can see a pin bar and rejection from our Fibonacci expansion 61.8%. My advice is to watch for potential buying opportunities. The first resistance level is around the price of 1.4440.

Daily Fibonacci pivot levels:

Resistance levels:

R1: 1.4447

R2: 1.4462

R3: 1.4486

Support levels:

S1: 1.4400

S2: 1.4384

S3: 1.4360

Trading recommendations: We are in neutral trend. So we need to a clear direction in the next period for better trading opportunities. Anyway, buying positions are preferable.

Petar Jacimovic is taking part in the “Analyst of the Year” award organized by MT5.com portal. If you like his article, please vote for him.

| ||

Performed by Petar Jacimovic, Analytical expert InstaForex Group © 2007-2015 |

EUR/NZD analysis for March 31, 2015

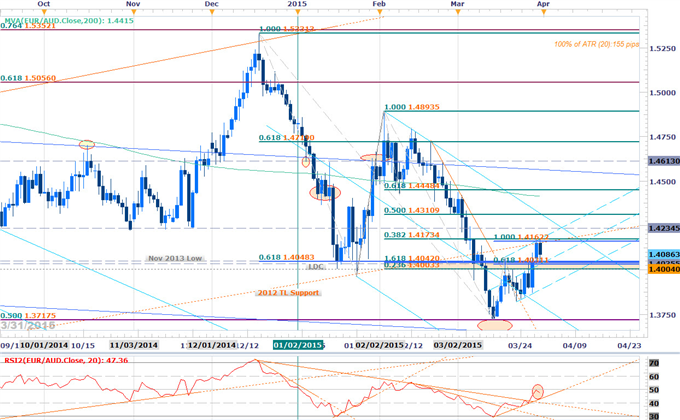

EURAUD Scalps Target Weekly Opening Range- Longs at Risk Sub-1.4175

Talking Points

Weekly Opening Range taking shape below key resistance

Break to verify/invalidate long-bias

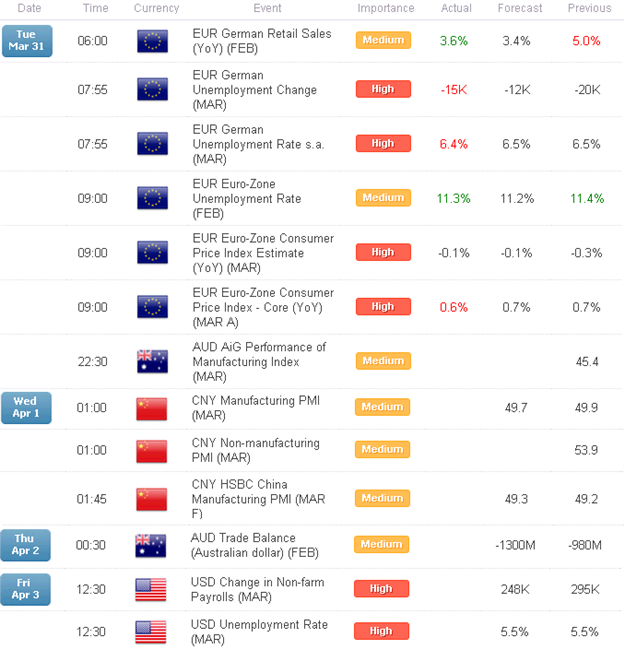

Event Risk on Tap ThisWeek

EUR/AUD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

EURAUD completes 100% extension off the lows into key resistance 1.4162/75

Key near-term support 1.4000/40 –bullish invalidation

Break below targets objectives into lower median-line support (dashed blue)

Topside breach targets 1.4235 / ML resistance off the February high

Daily RSI holding sub-50 (bearish)- Pending support trigger in play

Event Risk Ahead: Australia Building Approvals tonight, AU Trade Balance& China PMI Tomorrow & NFPs on Friday

EUR/AUD 30min

Notes:The weekly opening range is taking shape just below near-term resistance with the 1.4040-1.4175 region in focus. Near-term support & bearish invalidation extends into the 1.40-figure with a break below confirming a near-term reversal lower in the pair targeting support objectives into the lower median-line parallel, currently just above the 1.39-handle.

Bottom line: we’re at risk for a turn lower near-term with a break sub-1.4040 needed to shift our scalp bias back to the short-side. Interim resistance stands at 1.4105 backed by at 1.4165/75 (near-term bearish invalidation). A breach above this region targets 1.4235 / the longer dated upper MLP just shy of 1.43 (depending on time). Caution is warranted heading into the Chinese PMI numbers with the print likely to fuel added volatility in Aussie crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

Scalp Webinar: USD Defends Support Slope- Bulls at Risk Ahead of NFP

AUDUSD Reversal Scalp- Shorts Favored Sub 7850

EURJPY Long Scalps at Risk Below FOMC High- Interim Support 130.60

Webinar: Scalps Favor Dollar Correction- EUR/USD Eyes FOMC Highs

Bullish USD Outlook Mired Post FOMC- JPY, GBP & Gold in Focus

—Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

EURAUD Scalps Target Weekly Opening Range- Longs at Risk Sub-1.4175

Canada’s GDP Shrinks, Canadian Dollar Unfazed

Canada’s economy shrank at the start of the current year as was demonstrated by today’s report from Statistics Canada. Yet in a surprising display of resilience the Canadian currency jumped after the report instead of falling.

Canada’s economy shrank at the start of the current year as was demonstrated by today’s report from Statistics Canada. Yet in a surprising display of resilience the Canadian currency jumped after the report instead of falling.

Canadian gross domestic product fell 0.1 percent in January after rising 0.3 percent in December. It was not a good reading yet the Canadian dollar jumped sharply after the economic release. The possible reason for such behavior is that market participants anticipated a bigger drop by 0.2 percent.

The loonie’s resilience even more puzzling considering that crude oil demonstrated substantial losses today. It looks like the Canadian currency decided to completely ignore fundamentals during the current trading session.

USD/CAD was up from 1.2679 to 1.2783 intraday but retreated to 1.2671 as of 20:27 GMT today. CAD/JPY demonstrated similar pattern, bouncing to 94.70 after falling from 94.69 to 93.74 earlier. As most other currencies, the Canadian dollar gained on the euro, and EUR/CAD sank from 1.3735 to 1.3617.

If you have any questions, comments or opinions regarding the Canadian Dollar,

feel free to post them using the commentary form below.

Canada’s GDP Shrinks, Canadian Dollar Unfazed

Brazil's Levy says Fiscal Adjustment Is Not Enough, Gov't Needs to Recalibrate Brazil's Economy

Exclusive newsline by InstaForex is your reliable assistant in the Forex world.

Top Forex analysts with immense experience in Forex trading, dozens of comprehensive analytical reviews daily, various subjects and types of analysis. Moreover, economic calendar by InstaForex Company can help you be in the middle of informational flow.

Brazil's Levy says Fiscal Adjustment Is Not Enough, Gov't Needs to Recalibrate Brazil's Economy

Euro falls to U.s. Session Low Vs Dollar After Stronger-Than-expected U.s. Consumer Confidence Data in March

Exclusive newsline by InstaForex is your reliable assistant in the Forex world.

Top Forex analysts with immense experience in Forex trading, dozens of comprehensive analytical reviews daily, various subjects and types of analysis. Moreover, economic calendar by InstaForex Company can help you be in the middle of informational flow.

Euro falls to U.s. Session Low Vs Dollar After Stronger-Than-expected U.s. Consumer Confidence Data in March

Technical analysis of EUR/JPY for March 31, 2015

Technical outlook and chart setups:

The EUR/JPY pair is seen to be dropping below 128.50 and could be heading towards fresh lows at the sessions to come by. It is recommended to exit long positions for now and prepare to sell rallies. Immediate support is seen at 128.00 followed by 127.00 and lower, while resistance is seen at 130.50 followed by 131.50, 132.00, and higher respectively. The pair could drop below 128.00 and find support ahead of 127.00. It remains to be seen if prices continue falling below 128.00 before initiating positions.

Trading recommendations:

Exit long positions for now and remain flat.

Good luck!

| ||

Performed by Harsh Japee, Analytical expert InstaForex Group © 2007-2015 |

Technical analysis of EUR/JPY for March 31, 2015

Daily analysis of USDX for March 31, 2015

The USDX did a breakout at the level of 98.01 to the upside during the Monday session, and now it is looking to reach the resistance zone around 99.12. The current fractal structure is pointing to the upwards. In the last articles, we mentioned the idea about a considerable rebound taking in place at the support level of 96.60.

The bullish bias is now very clear in the H1 chart, as the USDX is doing a consolidation above the 200 SMA and the support level at 98.36. If the USDX breaks the resistance level at 98.77, it would open the way to reach the next resistance zone around 99.16. Now, the current price actions are all in favor of bulls, as the upward momentum is strong.

Show full picture

Daily chart’s resistance levels: 99.12 / 100.35Dailychart’s support levels: 98.01 / 96.60H1 chart’s resistance levels: 98.77 / 99.16H1 chart’s support levels: 98.36 / 97.90

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bullish candlestick; the resistance level is at 98.77, take profit is at 99.16, and stop loss is at 98.37.

Felipe Erazo is taking part in the “Analyst of the Year” award organized by MT5.com portal. If you like his article, please vote for him.

| ||

Performed by Felipe Erazo, Analytical expert InstaForex Group © 2007-2015 |

Daily analysis of USDX for March 31, 2015

Daily analysis of GBP/USD for March 31, 2015

The GBP/USD pair is currently riding the overall bearish trend and its looking to reach the support level at 1.4649. The general structure of the pair tells us about future strong falls, as the GBP/USD pair was forming fractals below the resistance zone around 1.4948. In the daily chart, the lower low pattern is still bearish. The MACD indicator is still at neutral territory.

Show full picture

The yesterday’s session was bearish for the GBP/USD pair, because it was looking to reach new lows, as the pair has been moving inside a low range. Immediate support is located at the level of 1.4774 and we could expect for more falls until 1.4721. Be patient and try to ride the bearish side on the GBP/USD pair in the intraday way as much as possible.

Show full picture

Daily chart’s resistance levels: 1.4820 / 1.4948Dailychart’s support levels: 1.4649 / 1.4505H1 chart’s resistance levels: 1.4842 / 1.4921H1 chart’s support levels: 1.4774 / 1.4721

Trading recommendations for today: Based on the H1 chart, place short (sell) orders only if the GBP/USD pair breaks a bearish candlestick; the support level is at 1.4774, take profit is at 1.4721, and stop loss is at 1.4825.

Felipe Erazo is taking part in the “Analyst of the Year” award organized by MT5.com portal. If you like his article, please vote for him.

| ||

Performed by Felipe Erazo, Analytical expert InstaForex Group © 2007-2015 |

Daily analysis of GBP/USD for March 31, 2015

Technical analysis of GBP/CHF for March 31, 2015

Technical outlook and chart setups:

The GBP/CHF pair seems to be breaking above 1.4400 at the moment. The next resistance should be met at 1.4630. Please note that the pair has bounced off the Fibonacci 0.382 support of the rally between the levels of 1.2800 and 1.5200 respectively. Potential still remains for a fresh high above 1.5200 from here on. Immediate support is seen at 1.4000, followed by 1.3850, while resistance is seen at 1.4630 followed by 1.4800 and higher respectively. Bulls should remain in control until prices stay above 1.4200.

Trading recommendations:

Remain long, stop at 1.4100, target is open.

Good luck!

| ||

Performed by Harsh Japee, Analytical expert InstaForex Group © 2007-2015 |

Technical analysis of GBP/CHF for March 31, 2015

Technical analysis of Silver for March 31, 2015

Technical outlook and chart setups:

Silver correction continues and it has reached the level of $16.45, which is Fibonacci 0.382 support, before pulling back. The metal could still drift lower towards $16.00 around the Fibonacci 0.618 levels as depicted here. It is recommended to initiate long positions around the level of $16.00 with risk below $15.30 for now. Immediate support is seen at $15.80 followed by $15.30 and lower, while resistance is seen at $17.40/50 followed by $18.40/50 and higher respectively. A potential right shoulder is also seen to unfold at the level of $16.00.

Trading recommendations:

Remain flat for now, look for buying at $16.00.

Good luck!

| ||

Performed by Harsh Japee, Analytical expert InstaForex Group © 2007-2015 |

Technical analysis of Silver for March 31, 2015

Next Leg Lower in EUR-crosses in Focus after Weaker CPI

Talking Points:

- EURUSD breaks below key $1.0800 support, now eyes $1.0612.

- EURGBP, EURJPY lose respective uptrends from March lows.

- See the March forex seasonality report for trends in the QE-era.

Short-term technicals are realigning with longer-term bearish inclinations across the EUR-complex. EURUSD’s H4 MACD and Stochastic bearish crossovers have appeared alongside price losing its uptrend from the March 15, 19, and 27 lows, as well as the March 27 swing low. Likewise, EURGBP and EURJPY have moved below the significant swing lows put in late last week, signifying a broader resumption of the Euro downtrend.

While the is an atypical week – month-end and quarter-end rebalancing effects today, capital redeployment tomorrow and Thursday, and market holidays on Friday with alongside US Nonfarm Payrolls (which has only happened 11 times since 1980) – it’s difficult to ignore the significance of prices across the EUR-spectrum realigning with their longer-term trends.

At a minimum, today’s data helps the market refocus its view to the longer-term perspective that the ECB’s QE program is a necessity, and that there is a growing divergence between prospective ECB and Fed monetary policies for the next 12-18 months. See the Euro weekly trading forecast “Euro Relief Rally May Hit Wall as Market Refocuses on EZ CPI, US NFPs” for a more in-depth outlook.

See the above video for technical considerations in EURUSD, EURGBP, and EURJPY.

Read more: Top Events this Week Include EZ CPI, Canadian GDP, and US NFPs

— Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

Next Leg Lower in EUR-crosses in Focus after Weaker CPI

Euro Bears at Risk on Sticky CPI- Outlook Remains Bearish Below 1.10

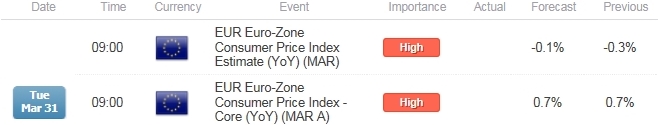

- Euro-Zone Consumer Price Index (CPI) to Contract at Slower Pace.

- Core Inflation to Hold Steady at Annualized 07% for Second-Month.

For more updates, sign up for David’s e-mail distribution list.

Trading the News: Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s Consumer Price Index (CPI) may dampen the bearish sentiment surrounding the Euro and spur a short-term rebound in EUR/USD should the report highlight sticky price growth across the monetary union.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Indeed, signs of stabilizing price pressures may encourage the European Central Bank (ECB) to soften its dovish outlook for monetary policy, and President Mario Draghi may talk down expectations for a further expansion in the easing cycle as the region gets on a more sustainable path.

Expectations: Bullish Argument/Scenario

The pickup in business sentiment along with the expansion in private-sector consumption may generate sticky price growth in the euro-area, and a positive development may heighten the appeal of the single currency as market participants scale back bets for additional monetary support.

Risk: Bearish Argument/Scenario

However, falling input prices paired with the ongoing contraction in private-sector lending may encourage European firms to further discount consumer prices, and a dismal inflation print may trigger a short-term decline in the exchange rate as the ECB keeps the door open to implement more non-standard measures.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bullish EUR Trade: Headline & Core Inflation Exceed Market Expectations

Need green, five-minute candle following the release to consider a long EUR/USD trade

If market reaction favors a bullish Euro trade, buy EUR/USD with two separate position

Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish EUR Trade: Euro-Zone CPI Highlights Greater Threat for Deflation

Need red, five-minute candle to favor a short EUR/USD trade

Implement same setup as the bullish Euro trade, just in opposite direction

Read More:

Scalp Webinar: USD Defends Support Slope- Bulls at Risk Ahead of NFP

AUD/USD Retail FX Flips Net-Long; March Low (0.7559) on Radar

Potential Price Targets For The Release

EUR/USD Daily Chart

Chart – Created Using FXCM Marketscope 2.0

String of failed attempts to close above the 1.1000 region may highlight a near-term topping process in EUR/USD especially as the RSI struggles to retain the bullish momentum from earlier this month.

Interim Resistance: 1.0970 (38.2% expansion) to 1.0990 (50% retracement)

Interim Support: 1.0620 (61.8% expansion) to 1.0640 (38.2% expansion)

Impact that the Euro-Zone CPI report has had on EUR during the last release

January 2015 Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s Consumer Price Index (CPI) slipped at an annual pace of 0.3% in February after contracting 0.6% the month prior, while the core rate of inflation held steady at an annualized 0.6% for the second consecutive month. Despite the ongoing slack in the euro-area, the European Central Bank’s (ECB) quantitative easing (QE) program may continue to shore up the ailing economy as the President Mario Draghi adopts an improved outlook for the monetary union. The initial reaction in the Euro was short-lived as EUR/USD struggled to hold above the 1.1225 region, and the single currency struggled to hold its ground throughout the North American trade as the pair ended the day at 1.1181.

— Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

Euro Bears at Risk on Sticky CPI- Outlook Remains Bearish Below 1.10

Monday, March 30, 2015

Technical analysis and trading recommendation for EUR/USD for March 31, 2015

German CPI: the inflation rate in Germany is expected to be 0.3% in March 2015. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.5% on February 2015.

Spanish flash CPI: according to the flash estimate published by the INE, the annual inflation is 0.7% in March 2015. This indicator provides a preview of the CPI that would imply an increase of four-tenths in its annual rate. In February it changed by 1%. This increase is mainly explained by the increase in fuel prices (gas and diesel oil).

Upcoming events: Macro calendar offered a data-heavy day in the eurozone and European countries. Today, traders eye on German retail sales, unemployment change, French consumer spending, Italian unemployment change, CPI flash estimates, core CPI flash estimates, and unemployment rate. It’s a big data for the euro. We are expecting another positive data from German and French.

Technical view: The US data dominated at yesterday’s session. USD rebounds from the lower levels, pressured on its peers. The euro fell against USD at yesterday’s session but managed to hold at 20Dsma. Parallel support is found at 1.0800 below this, 1.0768 will be crucial. In case the price closes below 1.0768, we can expect 150 more pips on the down side. The selling pressure is likely to be applied below 1.0800 and strong selling pressure will attack below 1.0768 with targets at 1.0700, 1.0650, and 1.0620. In the hourly chart, we can observe lower lows and lower highs formation. We have been advising the near term trend was going to be capped. Intraday resistance exists at 1.0860 and weekly resistance is seen at 1.0950. We recommend fresh selling below 1.0800. Intraday support is found at 1.0820 and 1.0800, last hope is at 1.0768. In case US consumer confidence does not meet the expectations, then we can see some bump up in the price. We recommend buying above 1.0860 with targets at 1.0900 and 1.0950.

Trade: selling below 1.0800, panic below 1.0760.

Buying above 1.0860, strong upswing likely above 1.0950

Show full pictureKey technical levels of the euro against USD/JPY/CAD/GBP, and AUD :EUR/USD-Weekly mode favors SELLING with sl 1.0950EUR/JPY- Weekly mode favors turned to selling with sl 130.50EUR/CAD- Weekly mode favors turned to buying with sl 1.3680EUR/GBP. Weekly mode still favors buying, but struggling at 50DsmaEUR/AUD. buying with sl 1.3940 with target at 1.4150, initiated at 1.3850.Target completed high made 1.4186. Use another dip to buy at 1.4080

We will re-analyze if the weekly trend changes.

| ||

Performed by Joseph Wind, Analytical expert InstaForex Group © 2007-2015 |

Technical analysis and trading recommendation for EUR/USD for March 31, 2015

Technical analysis and trading recommendation of USD against CAD & YEN for March 31, 2015

According to the report of the National Association of Realtors, pending home sales increased in February to their highest level since June 2013. Sizeable gains in the Midwest and West were offset by smaller declines in the Northeast and South. The pending home sales index,* a forward-looking indicator based on contract signings, rose 3.1 percent to 106.9 in February from a slight downward revision of 103.7 in January. Now, it is 12.0 percent above from 95.4 in February 2014. The index is at its highest level since June 2013 (109.4). It has increased year-over-year for six consecutive months and is above 100 (considered an average level of activity) for 10 consecutive months. USD/CADAs we expected, the pair gave an upside inverse head and shoulder rallied nicely. We recommended buying in case the price corrected towards 1.2400 or 1.2370. The pair made a low at 1.2410 and changed its direction towards 1.2710. Now, we are in money of 300 pips. We request traders who followed my trade to move their stop loss at 1.2600. Until the price closes above 1.2540, bulls remain in play. The pair prepared a strong support base between 1.2350 and 1.2300 at 200MSMA. Until prices closes above 1.2300, buying on dips still remains in play.

According to the report of the National Association of Realtors, pending home sales increased in February to their highest level since June 2013. Sizeable gains in the Midwest and West were offset by smaller declines in the Northeast and South. The pending home sales index,* a forward-looking indicator based on contract signings, rose 3.1 percent to 106.9 in February from a slight downward revision of 103.7 in January. Now, it is 12.0 percent above from 95.4 in February 2014. The index is at its highest level since June 2013 (109.4). It has increased year-over-year for six consecutive months and is above 100 (considered an average level of activity) for 10 consecutive months. USD/CADAs we expected, the pair gave an upside inverse head and shoulder rallied nicely. We recommended buying in case the price corrected towards 1.2400 or 1.2370. The pair made a low at 1.2410 and changed its direction towards 1.2710. Now, we are in money of 300 pips. We request traders who followed my trade to move their stop loss at 1.2600. Until the price closes above 1.2540, bulls remain in play. The pair prepared a strong support base between 1.2350 and 1.2300 at 200MSMA. Until prices closes above 1.2300, buying on dips still remains in play.

Show full pictureUSD/JPY

As we expected, the pair gave an upside inverse head and shoulder rallied towards our target.

We have been recommending buying with sl 117.50. The pair made a low at 118.33 facing strong resistance at 50Dsma. At yesterday’s session, we expected another near-term rally in case the price closed above 50Dsma. The very same day, it managed to close above 50Dsma. Today, the pair faced resistance at 20Dsma 120.40 at the Asian session. The price trading pattern is shifted between 120.40 and 119.40. We recommend intraday buying above 120.40 with targets at 120.60, 121.00, and 121.20. A daily close below 117.50 leads to another leg down towards 116.00 and 115.00. Bulls are safe until the price closes above 117.50 100Dema. Trade: Positional buyers, move your trailing stop loss at 119.40. At yesterday’s session, we advised fresh buying above 119.50.

Today, traders eye on consumer confidence data. In case of positive reading, another sharp run is likely to take place in the near term.

| ||

Performed by Joseph Wind, Analytical expert InstaForex Group © 2007-2015 |

Technical analysis and trading recommendation of USD against CAD & YEN for March 31, 2015

Technical analysis of EUR/USD for March 31, 2015

When the European market opens, some economic data on the Italian Prelim CPI m/m, Unemployment Rate, Core CPI Flash Estimate y/y, and CPI Flash will be released.The US is likely to log economic data about the CB Consumer Confidence, Chicago PMI, and S&P/CS Composite-20 HPI y/y. So, EUR/USD is expected to move low to medium volatility during this day amid the reports.

TODAY TECHNICAL LEVELS:

Breakout BUY Level: 1.0880.

Strong Resistance:1.0874.

Original Resistance: 1.0863.

Inner Sell Area: 1.0852.

Target Inner Area: 1.0827.

Inner Buy Area: 1.0802.

Original Support: 1.0791.

Strong Support: 1.0780.

Breakout SELL Level: 1.0774.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Arief Makmur is taking part in the “Analyst of the Year” award organized by MT5.com portal. If you like his article, please vote for him.

| ||

Performed by Arief Makmur, Analytical expert InstaForex Group © 2007-2015 |

Technical analysis of EUR/USD for March 31, 2015

Technical analysis of USD/JPY for March 31, 2015

In Asia, Japan is going to release data on the Housing Starts y/y and Average Cash Earnings y/y.US is expected to publish economic data about CB Consumer Confidence, Chicago PMI, and S&P/CS Composite-20 HPI y/y. So, there is a strong probabilitythat the USD/JPY pair will move with low to medium volatility during the day.

TODAY TECHNICAL LEVELS:

Resistance. 3: 120.34.

Resistance. 2: 120.60.

Resistance. 1: 120.37.

Support. 1: 120.07.

Support. 2: 119.84.

Support. 3: 119.60.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Arief Makmur is taking part in the “Analyst of the Year” award organized by MT5.com portal. If you like his article, please vote for him.

| ||

Performed by Arief Makmur, Analytical expert InstaForex Group © 2007-2015 |

Technical analysis of USD/JPY for March 31, 2015

Euro, Aussie Dollar May Rise as Yen Falls on Greece Funding Deal

Talking Points:

Euro to Look Past CPI Data, Focus on Greece Debt Negotiations

Greek Deal May Boost Aussie and NZ Dollar, Boost Japanese Yen

Access Real-Time FX Markets Analysis with DailyFX on Demand

The preliminary set of March Eurozone CPI figures headlines the economic calendar in European hours. The benchmark year-on-year inflation rate is expected to register at 0.3 percent, rising for a second consecutive month. The outcome seems unlikely to offer much by way of lasting Euro volatility however considering the results’ limited impact on the near-term ECB policy outlook.

Rather, the spotlight is likely to remain on Greece. Athens submitted a list of proposed reforms on Friday. The markets now await the verdict on whether the “institutions” representing Greece’s creditors – the EU, the ECB and the IMF – will approve it and unlock the next round of bailout funding. Investors fear that if external funding is not secured, a cash crunch and subsequent default may lead to the country’s exit from the Eurozone.

On balance, both sides of the negotiation are interested in a deal. Prime Minister Alexis Tsipras and company surely realize that a disorderly redenomination will probably compound the country’s economic woes and cost them their jobs. Meanwhile, EU and IMF officials no doubt prefer to avoid a “Grexit” scenario for fear of the precedent it may set. On balance, this means that some kind of accommodation is more likely than not.

An accord that prevents a default and keeps Greece in the currency bloc is likely to prove supportive for the single currency. Follow-through may be somewhat limited however as on-going ECB QE casts a dark cloud over the near-term outlook. It may likewise boost overall risk appetite, sending the sentiment-geared Australian and New Zealand Dollars upward while punishing the safe-haven Japanese Yen. Needless to say, failing to reach a deal stands to produce the opposite response.

New to FX? START HERE!

Asia Session

European Session

Critical Levels

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya’s analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

Euro, Aussie Dollar May Rise as Yen Falls on Greece Funding Deal

How to Handle Multiple Technical Outlooks when Trading

Talking Points:

Strong vs. Corrective Trends

Deciding Which Trade To Take

Allowing Trade Size To Calm You down

“He also taught me one other thing that is absolutely critical: You have to be willing to make mistakes regularly; there is nothing wrong with it. Michael taught me about making your best judgment, being wrong, making your next best judgment, being wrong, making your third best judgment, and then doubling your money.”

-Bruce Kovner, Interview in Market Wizards by Jack Schwager

Have you wondered what makes a market tradable? In short, you have to have two parties who agree on price but disagree on value. The seller thinks that the price is high relative to where price will be in the near or distant future whereas buyers think they’re getting a steal by being able to buy at the current price. In a tradable market, following the trend is preferred but deciding where to enter is up to you.

Strong vs. Corrective Trends

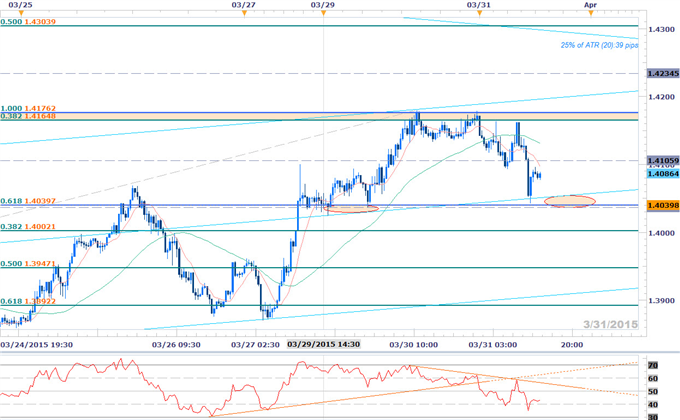

Rarely is there consensus across the board where a majority of credible participants in the market like banks, traders, and economists agree. This rarity recently developed in EURUSD, where banks continued to lower their forecast for EURUSD by yearend. Many who started their outlook towards parity began re-issuing outlooks towards the 0.8500-0.9000 region as the price continued to fall beyond expectations.

EURUSD Has Been on the Highway to Parity since Summer 2014

Presented by FXCM’s Marketscope Charts

Some traders will look at a chart like the one above and say that it only makes sense to sell as the trend is down. However, there are others that will say, the time to buy is right as price is sure to bounce somewhat. Often, a mix of both views is best whereas you wait for a bounce to clear resistance and for a higher low to develop and buy off of that higher low with an appropriate protective stop point.

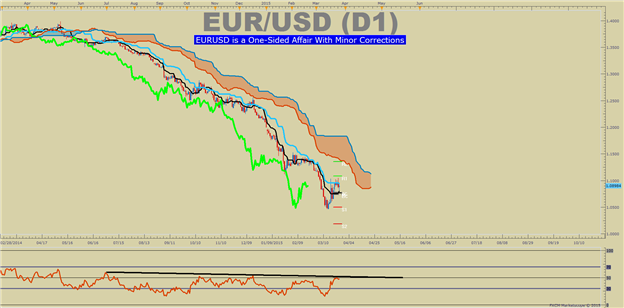

Of course, some charts aren’t as clear cut as EURUSD. This is especially the case on shorter-term charts like USDJPY over the last few months. Price appears to be converging between resistances around 122 & a rising support line coming up from 115. This dilemma causes traders to discern whether they should enter in an ongoing trend or wait for a correction to enter.

USDJPY Getting Set For Next Big Move?

Presented by FXCM’s Marketscope Charts

Deciding Which Trade to Take

Many traders know to trade with the trend but there is also an emotional fear that creeps in before entering the trade. The fear often comes in the form of a question. What if I’m the last one in this trend and it reverses on me? While it is possible, buying the top can be akin to the unlucky lottery as a long-term trend change, especially in FX, is rare as many fundamental events often go into FX trends.

Nevertheless, this fear can prompt some traders to look for a correcting trend. The USDJPY above is an example of a correcting trend where as a trader would look to trade in the direction of the trend when a breakout develops and validates the larger trend’s continuation. This is a popular approach of many traders as the correction against the larger trend can allow new traders into the market who will take the move the next leg higher whereas joining mid trend does have the risk of entering near an interim top, although entering at a major top is again, a rare occurrence.

Allowing Trade Size to Calm You Down

If you’re uncertain about which way to go, either entering in the direction of the larger trend as it stands or waiting for a correction to enter, you’re not alone. What’s more, if you’d like to be in the trade, you can simply in the direction of the trend with half the trade size you would normally put on and add the second half on a continuation move in the direction of trend after a correction or along the way with any dips that prove to be a higher low in an uptrend, or lower high in a downtrend.

Either way, limiting your trade size or keeping your trade size the same and increasing your balance is a great approach on multiple levels. First, it allows you to take part in the larger waves of the market without getting shook by the small ripples that develop day to day whereas an overleveraged trader is more than likely to be adversely affected by a smaller move that doesn’t impact the overall trend they may be wanting to trade. Second, a lower trade size allows you to stay in the trade longer allowing you to get more out of the large trends in FX. Staying with a move longer as opposed to jumping in and out can be a huge benefit compared to the overleveraged trader who catches a few hundred pips but leaves a thousand on the table because

Recommended Reading: Traits of Successful Traders eGuide

Summary

Whether the trend is in progress or correcting, you can trade with it as long as you don’t overleverage. When you drop your leverage, the mistakes hurt less and you tend to care less about individual trades, which is a good thing for most traders as the brain often puts too much emphasis on the current trade due to wanting to avoid pain or seek pleasure /gain without regard to the overall impact on your portfolio.

Happy Trading!

—Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@dailyfx.com

To be added to Tyler’s e-mail distribution list, please click here

Tyler is available on Twitter @ForexYell

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Trading With Moving Averages (14:25)

Reading the RSI, Relative Strength Index (13:57)

Money Management Principles (31:44)

Trade Like a Professional Workshop (1:44:14)

How to Handle Multiple Technical Outlooks when Trading

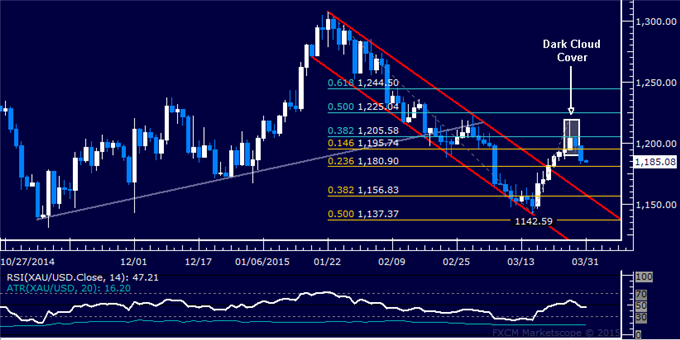

Crude Oil Digesting Losses, SPX 500 Tries to Resume Upward Trend

Talking Points:

US Dollar Jumps Higher from Monthly LowSupport

S&P 500 Attempts to Resume Six-Week Rising Trend

Gold Accelerates Lower, Crude Oil Digesting Losses

Can’t access the Dow Jones FXCM US Dollar Index? Try the USD basket on Mirror Trader. **

US DOLLAR TECHNICAL ANALYSIS – Prices are attempting to rebuild upside momentum after correcting downward as expected. Near-term resistance is at 12066, the 14.6% Fibonacci expansion, with a break above that on a daily closing basis exposing the 12149-77 zone (23.6% level, March 13 high). Alternatively, a reversal below the 11858-86 area (23.6% Fib retracement, March 18 low)clears the way for a test of the 38.2% threshold at 11679.

Daily Chart – Created Using FXCM Marketscope

** The Dow Jones FXCM US Dollar Index and the Mirror Trader USD basket are not the same product.

S&P 500 TECHNICAL ANALYSIS – Prices are attempting to rebuild upside momentum after falling as expected following the appearance of a bearish Evening Star candlestick pattern. A daily close above the 14.6% Fibonacci expansion at 2084.00 exposes the 2111.00-19.40 area (23.6% level, February 25 high). Alternatively, a move belowchannel floor support at 2062.60 targets the March 12 low at 2040.10.

Daily Chart – Created Using FXCM Marketscope

GOLD TECHNICAL ANALYSIS – Prices moved lower as expected after putting in a bearish Dark Cloud Cover candlestick pattern. A daily close below the 23.6% Fibonacci expansion at 1180.90 exposes the 38.2% level at 1156.83. Alternatively, a reversal above the 14.6% expansion at 1195.74 targets the 38.2% Fib retracement at 1205.58.

Daily Chart – Created Using FXCM Marketscope

CRUDE OIL TECHNICAL ANALYSIS – Prices reversed sharply lower after finding resistance below the $60/barrel figure. A break below the 38.2% Fibonacci expansion at 55.77 exposes the 50% level at 54.53. Alternatively, a reversal above the March 26 high at 59.75 targets the February 17 high at 62.98.

Daily Chart – Created Using FXCM Marketscope

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya’s analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

Crude Oil Digesting Losses, SPX 500 Tries to Resume Upward Trend