- U.S. Non-Farm Payrolls (NFP) to Increase 200+K for Sixth Straight Month.

- Would Mark Longest String of 200+K Prints Since 1997

Trading the News: U.S. Non-Farm Payrolls (NFP)

U.S. Non-Farm Payrolls (NFP) are anticipated to increase another 231K in July, and a positive employment print may produce a further decline in the EUR/USD as it puts increased pressure on the Federal Reserve to normalize monetary policy sooner rather than later.

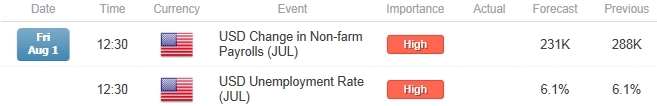

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The deviation in the policy outlook favors a bearish outlook for the EUR/USD as the European Central Bank (ECB) stands ready to implement more non-standard measures, and the NFP print may generate fresh 2014 lows in the euro-dollar should the release boost the interest rate outlook for the U.S.

Expectations: Bullish Argument/Scenario

The resilience in private consumption along with the marked rebound in economic activity may encourage firms to further expand their labor force, and a better-than-expected NFP print should produce a bullish reaction in the U.S. dollar as puts increased pressure on the Federal Open Market Committee (FOMC) to move away from its zero-interest rate policy (ZIRP).

Risk: Bearish Argument/Scenario

However, the downturn in business confidence along with the rise in planned job cuts may produce further headwinds for the U.S. labor market, and a dismal employment report may undermine the bullish sentiment surrounding the reserve currency as it raises the Fed’s scope to retain the highly accommodative policy stance for an extended period of time.

How To Trade This Event Risk(Video)

Join DailyFX on Demand for Full Coverage of U.S. Non-Farm Payrolls

Bullish USD Trade: NFPs Rises 231K+; Unemployment Holds at 6.1%

Need red, five-minute candle following the release to consider a short trade on EUR/USD

If market reaction favors a long dollar trade, sell EUR/USD with two separate position

Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Employment Print Falls Short of Market Forecast

Need green, five-minute candle to favor a long EUR/USD trade

Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The Release

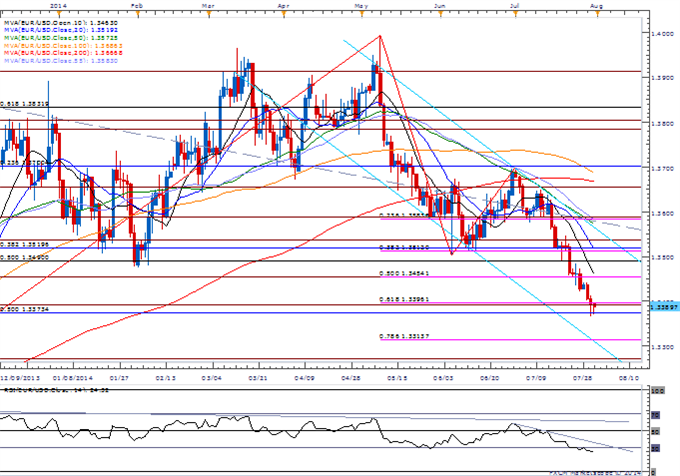

EUR/USD Daily

Chart – Created Using FXCM Marketscope 2.0

Remains at Risk for Further Decline as Long as RSI Holds Below 30

Interim Resistance: 1.3580 (23.6% expansion) to 1.3600 Pivot

Interim Support: 1.3300 Pivot to 1.3310 (78.6% expansion)

Read More:

Price & Time: The Longer-Term Implications of Recent USD Strength

EUR/JPY Remains Capped by Former Support; Lower-High in Place?

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month

June 2014 U.S. Non-Farm Payrolls

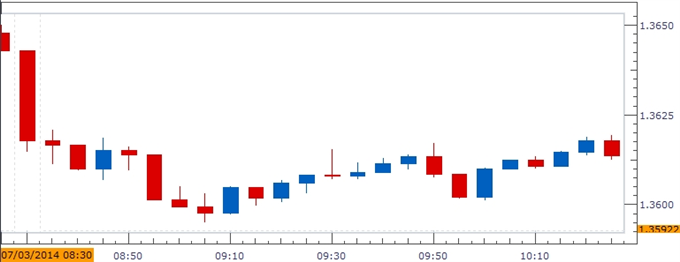

The U.S. economy added another 288K jobs in June following a revised 224K advance the month prior, while the jobless rate unexpectedly narrowed to an annualized 6.1% from 6.3% in May. The better-than-expected NFP print propped up the greenback, with the EUR/USD slipping below the 1.3625 region, and the reserve currency retained the bullish reaction going into the end of the week as the pair closed at 1.3608.

— Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

EUR/USD to Eye 1.3300 on Strong Non-Farm Payrolls (NFP) Report

No comments:

Post a Comment