To receive Ilya’s analysis directly via email, please SIGN UP HERE

Talking Points:

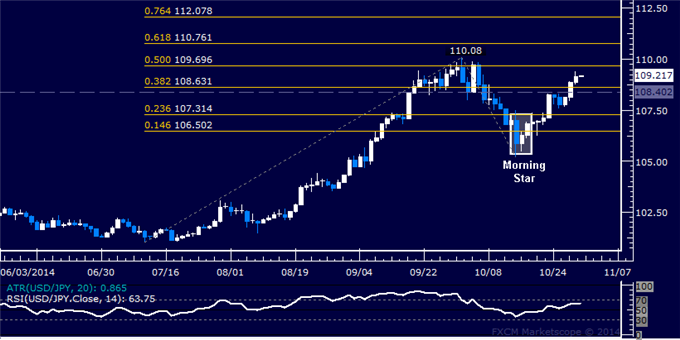

USD/JPY Technical Strategy: Flat

Support: 108.40, 107.31, 106.50

Resistance: 110.08, 110.76, 112.08

The US Dollar rose as expected against the Japanese Yen after producing a bullish Morning Star candlestick pattern. Near-term resistance is in the109.70-110.08 area, marked by the 50% Fibonacci expansion and the October 1 high, with a break above that on a daily closing basis exposing the 61.8% level at 110.76. Alternatively, a reversal below the 108.40-63 zone (October 2 close, 38.2% Fib) opens the door for a test of the 23.6% expansion at 107.31.

While entering long seems compelling from a purely technical perspective, we will tactically opt to pass on the trade. Upward continuation is questionable as the threat of on-coming risk aversion – a potentially significant negative catalyst for USDJPY – continues to loom large following a hawkish FOMC policy announcement and firm US GDP report. We will remain flat for now.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

Daily Chart – Created Using FXCM Marketscope 2.0

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

USD/JPY Technical Analysis: Resistance Above 110.00 in Focus

No comments:

Post a Comment