Talking Points

USD/JPY trades at highest level since December 2007

Key long term-retracements ahead

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

The Bank of Japan shocked the market earlier today with the unexpected announcement of another round of monetary stimulus. This has seen USD/JPY not surprisingly explode higher through the early October highs near 110.10 to trade at its highest level since late 2007. Markets are clearly excited, but the proximity of several key long-term retracement levels has us wondering if the exchange rate will stall out sooner than most expect. USD/JPY this past year has responded exceptionally well to key long-term retracement levels as the high in January came right at the convergence of the 50% retracement of the 2002-2011 decline and the 61.8% retracement of the 2007-2011 move lower in the 105.35/55 area. Not coincidentally the low this month in the pair came from those same levels with the successful retest of that support zone helping fuel the current push higher.

The next big retracement levels come into play around 112.40 (61.8% of 2002-2011 decline) and 113.75 (78.6% of 2007-2011 decline). Given USD/JPY’s recent penchant for responding to these sorts of levels we would not be surprised to see a counter-trend move develop around this zone. We like taking a shot of getting short USD/JPY if it trades to the top end of this zone in the week ahead.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

USD/JPY Monthly Chart: October 31, 2014

Charts Created using Marketscope – Prepared by Kristian Kerr

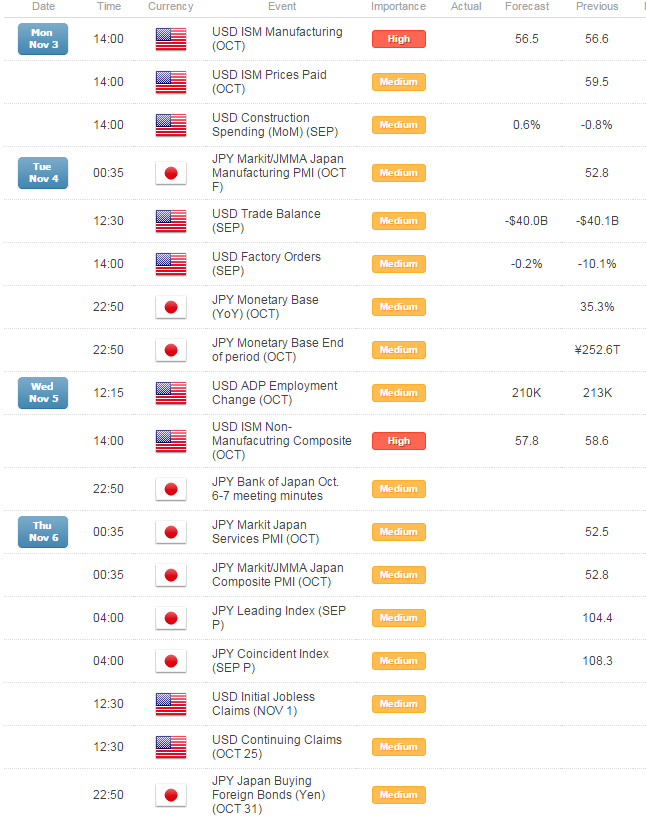

Key Event Risk in the Week Ahead:

LEVELS TO WATCH

Resistance: 112.40(Fibonacci), 113.75 (Fibonacci)

Support: 110.75 (Gann), 110.10 (Early October High)

Strategy: USD/JPY

Entry: Sell USD/JPY at 113.10

Stop: 1-day close above 114.00

Target: 110.80

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter at@KKerrFX.

Where USD/JPY Might Stall

No comments:

Post a Comment