Talking Points:

Trend traders should first find market direction

In a downtrend, traders should plan entries on lower lows

Stops can be managed using a previous low

There are many advantages to trading strong trends. Trend traders look for directional markets to bias their trading decisions and look for new entries. Below we can see a prime example of a trending market. Currently the EURJPY has declined as much as 582 pips since its March 2014 high, which stands at 143.78.

When looking at the chart below, it is important to notice the series of lower highs and lower lows printed on the graph. With the EURJPY trending downwards, this makes the currency pair a prime candidate for traders to initiate new sell positions. Today we will discuss trading breakouts with the trend. Let’s get started!

Learn Forex – EURJPY Daily Downtrend

(Created using FXCM’s Marketscope 2.0 charts)

Trading Breakouts

After establishing the current low in a downtrend, trading a breakout comes down to entry placement as well as risk management. By definition of a trend, the EURJPY must create a new low in order for the trend to continue. Knowing this, breakout traders will set entry orders under the current low to await execution. Entry orders are an effective way to prepare for a market breakout. An entry order can be set through the FXCM Trading station and allows you to set an order at a preset price. In the event that the market trades through that price, your order will be executed and your trade triggered into the market.

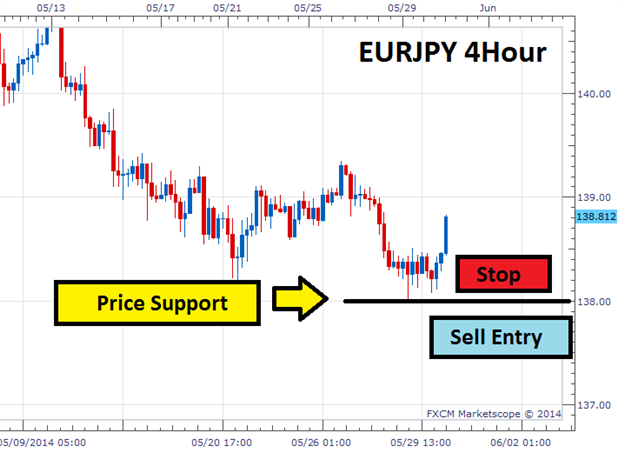

Using this methodology, we first need to find the standing low on the EURJPY. Currently the low stands at 137.96 and traders should plan on setting entries below this value. Aggressive traders can set their entries as close as one pip below the low. Conservative traders however may wait for a candle close, or set their orders further away from the point of breakout prior to market entry.

Learn Forex – EURJPY Breakout

(Created using FXCM’s Marketscope 2.0 charts)

Stops and Limits

After setting your entry order, traders should consider how to manage risk. There are many ways to do this when trading breakouts in trending markets. One of the easiest methodologies includes setting a stop order above the previous low. In a downtrend like the EURJPY, traders can again turn toward the current low at 137.96 handle for this task. Stop values can be placed above this point to exit positions in the event of a false breakout.

Once a stop is set, traders can then manage their profit targets by using a positive risk: reward ratio of their choosing.

Now that you are more familiar with trading a breakout methodology, you can practice what you have learned using a demo account. You can get started by registering for a Free Forex Demo with FXCM. This way you can develop your trading skills while continuing to track the market in real time.

—Written by Walker England, Trading Instructor

To contact Walker, email WEngland@FXCM.com . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.

Breakout Basics for Forex

No comments:

Post a Comment