To receive Ilya’s analysis directly via email, please SIGN UP HERE

Talking Points:

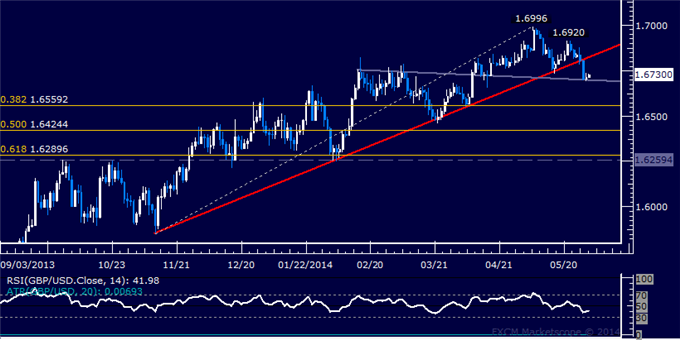

GBP/USD Technical Strategy: Flat

Support:1.6694 (“axis” line), 1.6559 (38.2% Fib ret.)

Resistance:1.6822 (trend line), 1.6920 (May 21 high)

The British Pound may have marked a pivotal reversal against the US Dollar after prices cleared rising trend support set from mid-November 2013. The pair is testing “axis” line support at 1.6694, with a daily close below that targeting the 38.2% Fibonacci retracement at 1.6559. Alternatively, a turn back above trend line support-turned-resistance – now at 1.6822 – clears the way for a challenge of the May 21 high at 1.6920.

Prices are too close to support to justify a short position from a risk/reward perspective. On the other hand, the absence of a confirmed bullish reversal signal warns against taking up the long side. Wewill remain flat for now.

Confirm your chart-based trade setups with the Technical Analyzer. New to FX? Start Here!

Daily Chart – Created Using FXCM Marketscope 2.0

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

GBP/USD Technical Analysis ? Stalling After Critical Break

No comments:

Post a Comment