Talking Points:

Range-bound market conditions occur approximately 70% of the time.

Trading ranges could offer more opportunistic risk-reward opportunity.

We share various ways that traders can look to approach range-bound conditions.

Most new retail traders hate trading in range-bound market conditions. The desire for trading a strong trend makes sense; these types of positions can offer fantastic risk-reward potential.

Unfortunately, trending markets are more of the exception than the rule. In most estimates, markets trend about 30% of the time, leaving the remaining ~70% for range-bound market conditions.

Nonetheless, most retail traders try to ignore the range. They’re unexciting and usually offer limited reward potential. Quite frankly, it’s more fun to just swing for the fences and to look for the huge profit potential of trending markets.

But a question that every trader needs to ask themselves: Are you trading for fun, or profit? I know this sounds ridiculous, but this is a serious question that every trader needs to contemplate.

If you’re trading for profit, you’ll probably want to include a range-bound strategy in your approach for the 70% of the time when a market isn’t trending.

In this article, we’re going to talk about trading the range.

The Most Important Part of Trading the Range

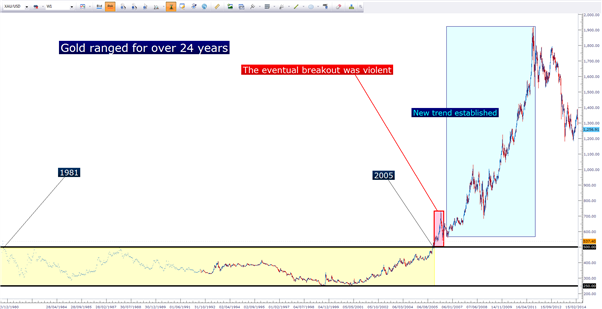

The biggest key to trading a range is to avoid being on the wrong side of the inevitable breakout. All ranges come to an end eventually. It may take a long time, like what we saw in Gold in the 80’s and 90’s when prices oscillated between $250 and $500 an ounce for over 24 years (1981-2005).

But when gold did finally begin to breakout, the price movements became violent and erratic. This leads directly into The Number One Mistake that Forex Traders Make. Taking outsized losses in comparison with their wins; to the point that one bad trade (like being short Gold in 2005-2011) can wipe away the gains from numerous winners. This is The Top Trading Mistake, and because of the limited up-side potential of range-bound markets one really large loss can be disastrous for a trader.

So, as usual – risk management is of the upmost importance: Stops should be used at all times and traders need to go into each trade with an exit plan should the setup not work out as desired.

Support and Resistance Identification is Critical

When a range breaks out into a new trend, traders speculating in that market should be aware of the ‘bigger-picture’ behind that movement.

As we explained in the Life Cycle of Markets, support and resistance is the guiding-hand that helps determine whether a market is trending, ranging, or in the process of breaking out. If price action is confined between support and resistance, the market is ranging. Once support or resistance yields, that’s a breakout. And as a market establishes higher or lower support and resistance, that’s a trend.

In the example below, we look at the 24+ year range in Gold. You can see the eventual breakout in 2005 highlighted in red, which led to the new up-trend that saw prices go over $1900 an ounce before topping out.

The Life Cycle of Gold

Created with Marketscope/Trading Station II; prepared by James Stanley

When that price of $500 was broken for the first time in 25 years, traders should have been on high alert. Short positions should have been avoided at-all-costs.

And this was a rather obvious price level of resistance. Not only had gold showed multiple iterations of support and resistance at $500 before 1981 (price action swings), but this is also a major psychological level. When a particular price level has multiple reasons for offering support and resistance, this is called ‘confluence’ and shows that there could be even more strength behind that price.

How to Trade the Range

Like any other market condition, there are numerous ways to go about trading range-bound market conditions. There is no individual right or wrong way to do it. As long as strong risk management is used, there are numerous ways one can approach it.

We discussed such a method involving price action in the article, How to Analyze and Trade Ranges with Price Action. As we had explained, traders can take the high and low points of a sideways market to determine when, where, and how to enter; as well as where to place the stop in the event that the range gets broken.

With this type of strategy, traders can allow the market to tell them whether or not a trade should be triggered. If the risk amount is larger than the profit potential, then a positive risk-reward ratio would not be possible and no trade should be taken.

If, however, the profit potential is two times larger than the size of the stop; the trade could be triggered as the speculator looks to avoid the Top Trading Mistake.

If you’d like to become more familiar with the topic of price action in an effort to more efficiently trade range-bound market conditions, the article Four Simple Ways to Become a Better Price Action Trader can help.

Traders can also look to utilize indicators and indicator-based approaches in a range. A popular indicator for identifying a ranging/trending market is the Average Directional Index (ADX). Using this indicator can function as a ‘filter’ to tell the trader whether or not the range-bound approach should be utilized.

After a proper range has been found, the trader can then look to trigger a position with an indicator such as CCI, RSI, or MACD.

Mr. Jeremy Wagner outlined such an approach in the article, the JW Ranger Strategy. The strategy incorporates divergence in the CCI indicator to look for short-term reversals.

– Written by James Stanley

James is available on Twitter @JStanleyFX

To join James Stanley’s distribution list, please click here.

Would you like to enhance your FX Education? DailyFX has recently launched DailyFX University; which is completely free to any and all traders!

Trading the Range

No comments:

Post a Comment