Talking Points

EUR/USD Technical Strategy: Sidelines Preferred

Lack of reversal signal suggests gains may continue

1.3900 likely to act as noteworthy resistance

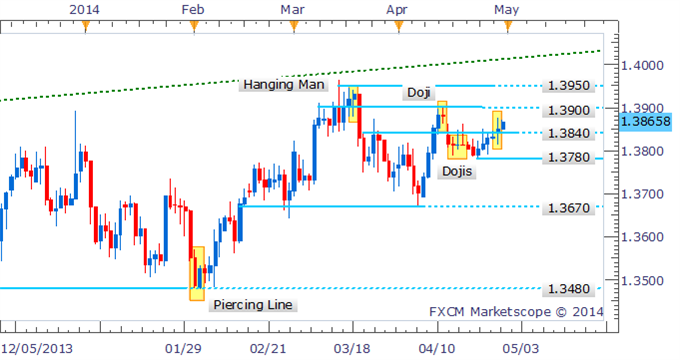

EUR/USD continues to march towards the critical 1.3900 handle following a break above resistance at 1.3840. While a Long-Legged Doji candlestick on the daily signals some hesitation amongst the bulls it is not enough to suggest a correction at this stage.

EUR/USD: Eyes 1.3900 With Bearish Reversal Signal Absent

Daily Chart – Created Using FXCM Marketscope 2.0

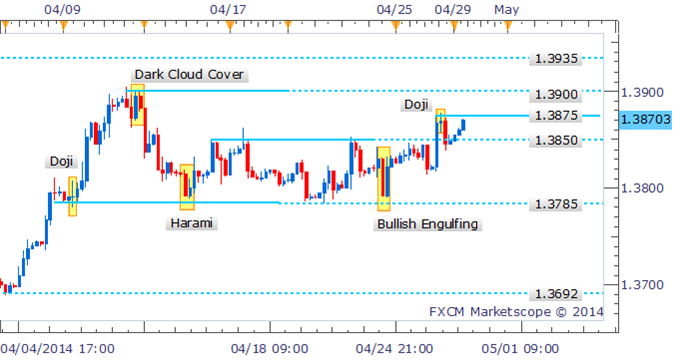

Drilling down to examine intraday price action; the Bullish Engulfing pattern on the 4 hour chart heralded the return of the bulls near key support at 1.3785. Some interim resistance at 1.3875 may prompt some sellers to emerge during the session ahead.

EUR/USD: Recovery May Continue Following Bullish Engulfing Pattern

4 Hour Chart – Created Using FXCM Marketscope 2.0

By David de Ferranti, Market Analyst, FXCM

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

EUR/USD Marches Higher As Doji Does Little To Discourage Bulls

No comments:

Post a Comment