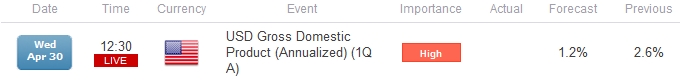

- U.S. Gross Domestic Product to Slow to 1.2%- Lowest Reading Since 1Q 2013.

- Personal Consumption to Grow 1.9% Compared to 3.3% in 4Q 2013.

Trading the News: U.S. Gross Domestic Product (GDP)

The advance GDP report is expected to show a marked slowdown in the U.S. economy as the growth rate is projected to expand a mere 1.2% during the first-quarter, and the bearish sentiment surrounding the dollar may gather pace going into May as the Fed retains a rather dovish tone for monetary policy.

What’s Expected:

Why Is This Event Important:

Indeed, the threat of a slower recovery may drag on interest rate expectations as the Federal Open Market Committee (FOMC) remains in no rush to normalize monetary policy, and a dismal GDP print may spark a further selloff in the greenback as it raises the risk of seeing the central bank retain the zero-interest rate policy (ZIRP) for an extended period of time.

Expectations: Bearish Argument/Scenario

Harsh winter conditions may have heightened the margin of slack in the real economy as the Fed retains a cautious tone for the world’s largest economy, and a weaker-than-expected GDP reading may spark another selloff in the reserve currency as Fed Chair Janet Yellen remains reluctant to move away from the highly accommodative policy stance.

Risk: Bullish Argument/Scenario

However, the improvement in household sentiment along with the resilience in private sector consumption may help to generate a positive growth report, and strong GDP figure may increase the appeal of the reserve currency as it puts increased pressure on the central bank to normalize monetary policy sooner rather than later.

How To Trade This Event Risk(Video)

To Cover the Market Reaction to the U.S. 1Q GDP report, Join DailyFX on Demand

BearishUSD Trade: U.S. 1Q GDP Narrows to 1.2% or Lower

Need green, five-minute candle following the print to consider a long EURUSD trade

If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

Place stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish USD Trade: Growth Rate Exceeds Market Forecast

Need red, five-minute candle to favor a short EURUSD trade

Implement same setup as the bearish dollar trade, just in reverse

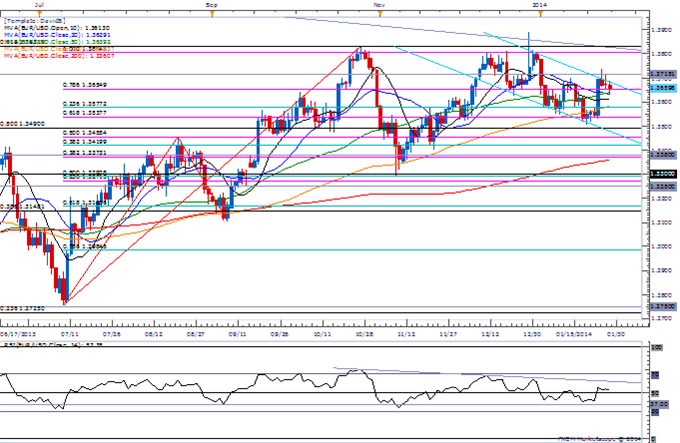

Potential Price Targets For The Release

EUR/USD Daily

Chart – Created Using FXCM Marketscope 2.0

Price & RSI Remains Stuck in Wedge/Triangle Formation From March

Interim Resistance: 1.3960-70 (61.8% expansion)

Interim Support: 1.3650 (78.6 expansion) to 1.3660 (23.6 retracement)

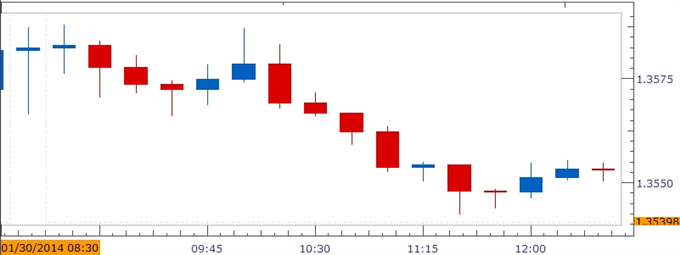

Impact that U.S. GDP has had on EUR/USD during the previous quarter

4Q 2013 U.S. Gross Domestic Product (GDP)

The U.S. economy grew another 3.2% during the last three-months of 2013 following the 4.1% rate of growth in the third-quarter, while Personal Consumption increased 3.3% amid forecasts for a 3.7% expansion. Despite the limited reaction to the mixed batch of data, the EUR/USD struggled to hold the 1.3550 region during the North American trade, but the pair firmed up going into the close as it ended the day at 1.3553.

-– Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

EUR/USD Risks Bullish Breakout as 1Q GDP Drags on Fed Policy Outlook

No comments:

Post a Comment