Talking Points

GBP/USD Technical Strategy: Longs Preferred

Doji on the daily highlights hesitation from the bulls

Traders await a bearish reversal signal to suggest a correction

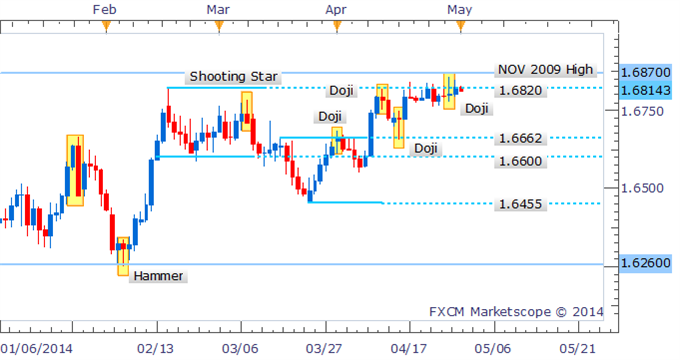

After teasing at a test of the critical 1.6870 mark in recent trading, the Pound continues to struggle resulting in the formation of a Doji candlestick on the daily. The pattern represents some hesitation from the bulls however it is not enough to suggest a correction at this stage.

GBP/USD: Struggles Below 1.6870

Daily Chart – Created Using FXCM Marketscope 2.0

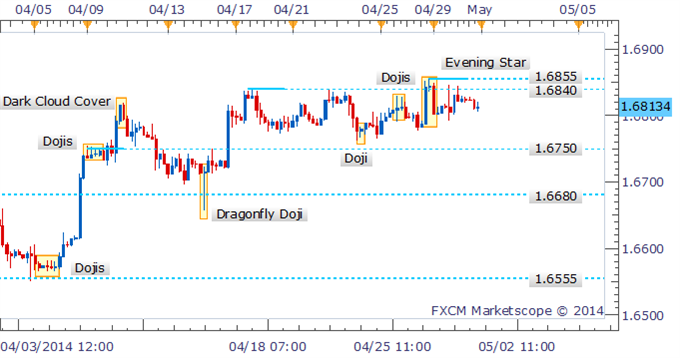

Intraday price action reveals a drawn-out struggle between the bulls and bears between 1.6750 and 1.6840. While it appeared that the bulls had won out following the pop above 1.6840, the pair was quick to retrace much of its gains signaling a lack of conviction amongst traders.

GBP/USD: Awaits A Reversal Signal In Intraday Trade

4 Hour Chart – Created Using FXCM Marketscope 2.0

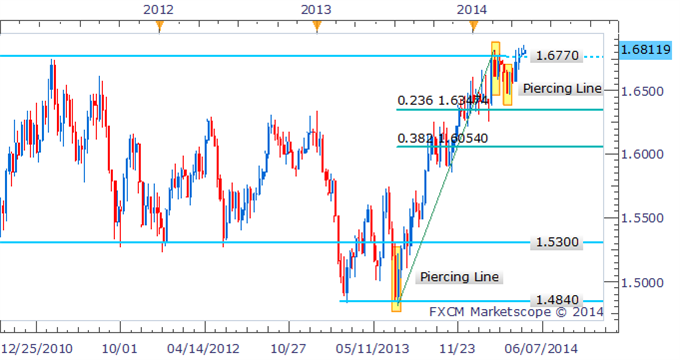

The Piercing Line pattern on the weekly helped to herald the return of the bulls. The perspective from the daily chart helps highlight the significance of the recent breakout to multi-year highs.

GBP/USD: Bulls Return As Piercing Line Forms on Weekly

Weekly Chart – Created Using FXCM Marketscope 2.0

By David de Ferranti, Market Analyst, FXCM

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

GBP/USD Bulls Hesitate Near Critical Resistance With Doji On The Daily

No comments:

Post a Comment