Talking Points

USD/JPY Technical Strategy: Pending Long

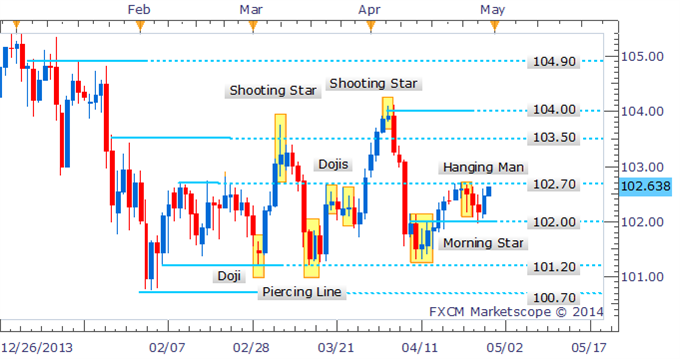

Daily close above 102.70 may offer new buying opportunity

Absence of bearish candlestick pattern suggests gains to continue

USD/JPY has made another run at the 102.70 resistance level in early European trading. While sellers may act to slow gains for the pair, we’re yet to see a bearish reversal pattern emerge that could signal a potential correction back to the 102.00 handle. A daily close above 102.70 would afford new long entries and may herald a more pronounced rally towards the 103.50 mark.

USD/JPY: Close Above 102.70 To Offer Buying Opportunity

Daily Chart – Created Using FXCM Marketscope 2.0

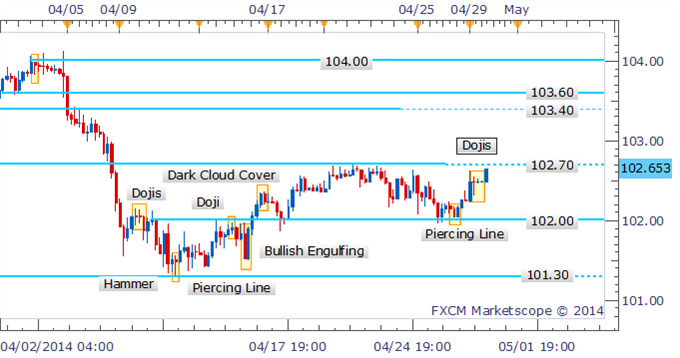

Drilling down to examine the four hour chart; as noted in yesterday’s report the Piercing Line pattern near the key 102.00 handle hinted at bounce during the session ahead. While some Dojis during Asian trading suggest some hesitation from the bulls, a bearish reversal signal remains absent.

USD/JPY: Bulls In Control With Bearish Signal Missing

Four Hour Chart – Created Using FXCM Marketscope 2.0

By David de Ferranti, Market Analyst, FXCM

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

USD/JPY Poised For Further Gains With Reversal Signal Missing

No comments:

Post a Comment