Talking Points:

US Dollar Digesting Rally Before Another Push Upward

S&P 500 Poised to Extend Gains After Resistance Break

Gold Finally Completes Bearish Chart Setup, Aims Lower

Can’t access to the Dow Jones FXCM US Dollar Index? Try the USD basket on Mirror Trader. **

US DOLLAR TECHNICAL ANALYSIS – Prices look poised to continue higher having set a critical double bottom at 10375, the October 2013 floor. An upward trend change signaled by a break above resistance at the top of a falling channel set from January saw follow-through with a break of resistance in the 10474-95 area. The bulls now aim to challenge the 10589-619 region, with a move above that opening the door for an advance to year-to-date highs. Alternatively, a reversal back below 10474 eyes channel top support-turned-resistance at 10434.

Daily Chart – Created Using FXCM Marketscope 2.0

** The Dow Jones FXCM US Dollar Index and the Mirror Trader USD basket are not the same product.

S&P 500 TECHNICAL ANALYSIS – Prices broke resistance at 1908.40, the 50%Fibonacci expansion, exposing the 61.8% level at 1919.40. A further push beyond that targets the 76.4% Fib at 1933.00.Alternatively, a reversal back below1908.40 clears the way for a descent to the 1897.40-1899.10 area, marked by the 38.2% expansion and the April 4 high.

Daily Chart – Created Using FXCM Marketscope 2.0

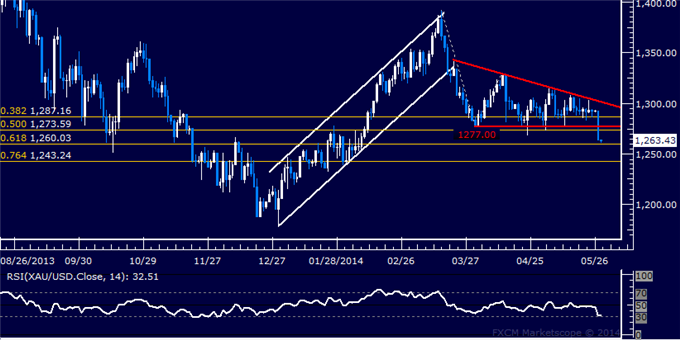

GOLD TECHNICAL ANALYSIS – Prices turned lower as expected, confirming a descending Triangle chart formation. Sellers now aim to challenge support at 1260.03, the 61.8% Fibonacci expansion. A break below this boundary exposes the 76.4% level at 1243.24. Resistance is in the 1273.59-77.00 area, marked by the 50% Fib and the Triangle bottom, with a reversal back above that eyeing the 38.2% expansion at 1287.16.

Daily Chart – Created Using FXCM Marketscope 2.0

CRUDE OIL TECHNICAL ANALYSIS – Prices are testing resistance in the 104.24-36 area, marked by a falling trend line set from early March and the 76.4% Fibonacci expansion. A break above this barrier initially exposes the 100% level at 105.16. Near-term support is at 103.67, the 61.8% Fib, with a move back below that eyeing the 50% expansion at 103.20.

Daily Chart – Created Using FXCM Marketscope 2.0

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya’s analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

Gold Aiming Lower as Prices Finally Validate a Bearish Chart Formation

No comments:

Post a Comment