Talking Points

EUR/USD falls to lowest level in over 3-months

Gold breaks key support level

Cyclical analysis points to a reversal in the days ahead

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

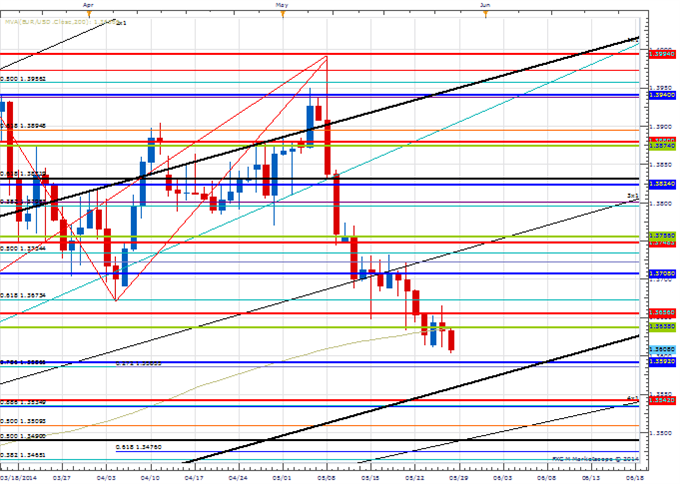

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD touched its lowest level since early February on Wednesday

Our near-term trend bias remains lower in EUR/USD while under 1.3710

Interim support is eyed around 1.3590 ahead of a major downside attraction between 1.3520/50

A medium-term cycle turn window is seen at the end of the week/early next week

Only strength through 1.3710 would sugggest the euro has bottomed ahaed of schedule

EUR/USD Strategy: Like the short side while below 1.3710, but looking to exit short positions by the end of the week.

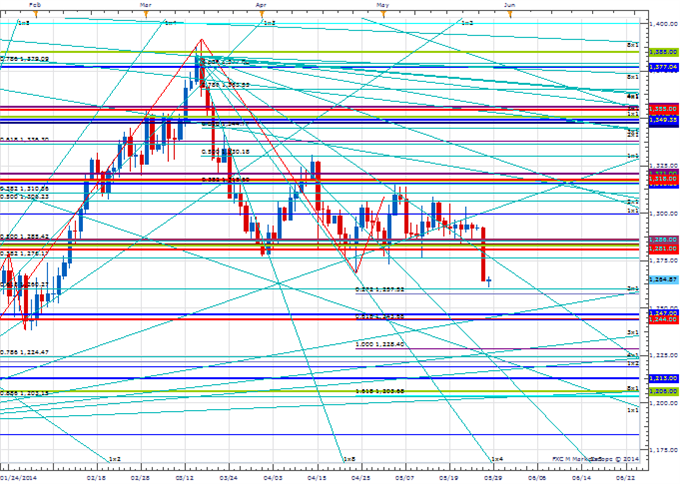

Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

XAU/USD fell sharply again on an option expiration day

The move below the late April cycle low has shifted our near-term trend bias negative

The 61.8% retracement of the December to March advance at 1260 is now an important downside pivot with weakness under this level needed to confirm that a more serious decline is really underway

A minor cycle turn window is seen here, but the middle of next month looks like the next major turn window in the yellow metal

A move back through 1286 would shift immediate attention higher

XAUUSD Strategy: Flat.

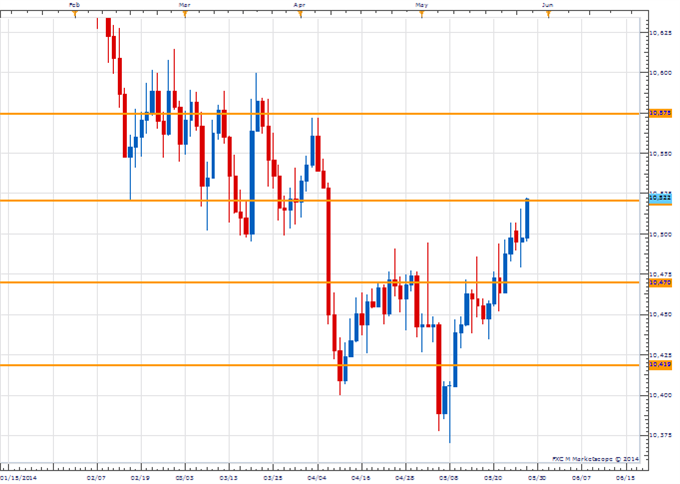

Focus Chart of the Day: FXCM DOLLAR INDEX

About a month ago we were looking for a strong rally in USD. At the time we were in very limited company as the fundamental background supposedly didn’t warrant a strong dollar. My how things have changed over the past few weeks! We were mostly focused on the euro, but even formerly unstoppable high fliers like Cable and NZD/USD have turned during this positive dollar period. In the broader scheme of things we like the dollar – especially over the second half of the year. In the near-term, however, we think the USD’s rise is getting a bit long in the tooth and will be limited to a few more days (a full week at best) as an important cycle turn window is eyed late this week/early next week. We will leave it to the fundamental guys to pinpoint the “reason” for this shift in sentiment, but from this corner month-end rebalancing shenanigans or a disappointment from the ECB look like clear candidates. We are unsure just how important this USD decline will be, but it would be surprising if it didn’t last at least a couple of weeks. Only new cycle highs in the FXCM Dollar Index after Thursday of next week would completely invalidate our early June negative USD view.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Price & Time: USD Advance Getting Long in the Tooth?

No comments:

Post a Comment