- Euro-Zone Consumer Price Index (CPI) to Mark the Slowest Pace of Growth Since October 2009.

- Core Inflation to Hold Steady at 0.9% for Second Straight Month.

For more updates, sign up for David’s e-mail distribution list.

Trading the News: Euro-Zone Consumer Price Index (CPI)

A further slowdown in the Euro-Zone’s Consumer Price Index (CPI) may prompt fresh monthly lows in the EUR/USD as it puts increased pressure on the European Central Bank (ECB) to implement more non-standard measures.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

The ECB may continue to push monetary policy into uncharted territory as the Governing Council struggles to achieve its one and only mandate to deliver price stability, and the bearish sentiment surrounding the Euro may gather pace throughout the remainder of the year amid the weakening outlook for growth and inflation.

Expectations: Bearish Argument/Scenario

The persistent slack in the real economy may paint a weakened outlook for price growth, and a dismal CPI print may generate a bearish reaction in the EUR/USD should the report highlight a greater threat for deflation.

Risk: Bullish Argument/Scenario

However, the unprecedented steps taken by the ECB may help to mitigate the downside risk for inflation, and a better-than-expected release may generate a more meaningful rebound in the Euro as it curbs bets of seeing a new wave of monetary support.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bearish EUR Trade: Headline & Core CPI Highlight Greater Threat for Deflation

Need red, five-minute candle following the release to consider a short EUR/USD trade

If market reaction favors selling Euro, short EUR/USD with two separate position

Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish EUR Trade: Euro-Zone Inflation Tops Market Expectations

Need green, five-minute candle to favor a long EUR/USD trade

Implement same setup as the bearish Euro trade, just in opposite direction

Read More:

COT: US Dollar Speculator Long Position is Largest on Record

Potential Price Targets For The Release

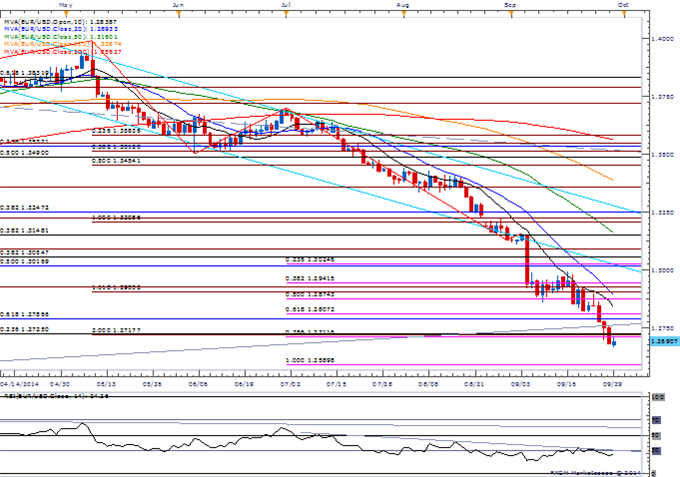

EUR/USD Daily

Chart – Created Using FXCM Marketscope 2.0

Downside targets remain favored as RSI retains bearish momentum & pushes deeper into oversold territory

Interim Resistance: 1.3010 (50.0% retracement) to 1.3020 (23.6% expansion)

Interim Support: 1.2590 (100% expansion) to 1.2600 pivot

Impact that the Euro-Zone CPI report has had on EUR during the last release

August 2014 Euro-Zone Consumer Price Index (CPI)

The Euro-Zone’s annualized Consumer Price Index (CPI) continued the downward trend and slipped to a 5-year low of 0.3% from 0.4% the month prior, while the core inflation rate unexpectedly rose 0.9% during the same period amid forecasts for a 0.8% print. The ongoing weakness in price growth may put increased pressure on the European Central Bank (ECB) to implement its own quantitative easing program amid the growing threat for deflation. Nevertheless, the initial reaction in the EUR/USD was short-lived as the pair consolidated around 1.3182 following the release, but the euro-dollar came under increased pressure during the North American trade as it ended the day at 1.3133.

— Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David’s e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

EUR/USD Downside Targets Favored Ahead of ECB on Slowing Inflation

No comments:

Post a Comment