Talking Points

USD/JPY Technical Strategy: Pending Long

Bulls Cautiously Return Following Lack Of Reversal Signals

Daily Close Above 109.40 May Open Advance On 110.65

USD/JPY’s thrusters appear to be faltering as a short body session suggests the bulls are lacking inspiration near the 109.40 barrier. Yet an ascent towards the August ’08 high at 110.65 may still be achievable with key reversal candlesticks lacking.

USD/JPY: Tepid Price Action Leaves Bearish Candlesticks Missing

Daily Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

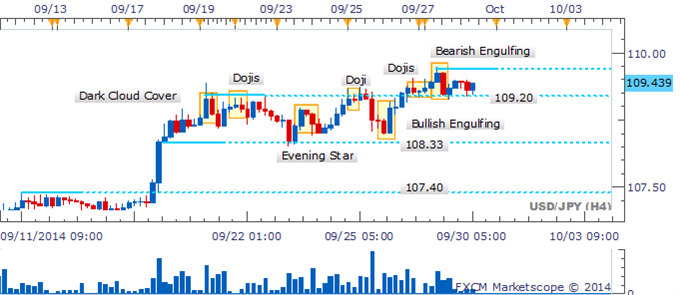

A Bearish Engulfing formation near the 110.00 ceiling indicated the bulls were relinquishing their grip on prices in intraday trade. While upside momentum appears to be fading the potential for a correction is questionable given the lack of follow-through to the candlestick pattern.

USD/JPY: Bearish Engulfing Candlestick Pattern Signaled Fading Upside Momentum

Four Hour Chart – Created Using FXCM Marketscope 2.0,Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

USD/JPY Thrusters May Reignite With Reversal Candlesticks Lacking

No comments:

Post a Comment