Talking Points

USD/JPY trying to break through key resistance

GBP/USD turns down again

NZD/JPY triggers multi-month Head & Shoulders pattern

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

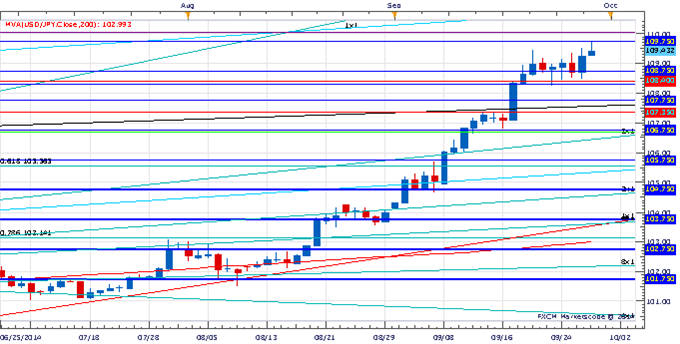

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/JPY broke to a new high for the year this morning before stalling at the 9th square root realtionship of the years’s low near 109.75

Our near-term trend bias is higher while over 108.30

A close over 109.75 is needed to confirm that a new leg higher is underway

An important turn window is eyed next week

A close below 108.30 would turn us negative on the exchange rate

USD/JPY Strategy: Like holding reduced long positions while above 108.30

Price & Time Analysis: GBP/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

GBP/USD has come under steady albeit modest pressure since failing at the 78.6% retracement of the September range at 1.6515

Our near-term trend bias is in Cable while below 1.6515

Interim support is eyed between 1.6175/35 ahead of the key 1.6055 level

A minor turn window is eyed today

A close over 1.6515 would turn us positive on the Pound

GPB/USD Strategy: Like the short side while below 1.65152

Focus Chart of the Day: NZD/JPY

NZD/USD was the big story overnight as the RNBZ confirmed the speculation that they are intervening in the market. The news prompted a large volume decline to its lowest level since July of last year. The moves in the crosses were perhaps more interesting as AUD/NZD moved impulsively higher and is not just a few pips shy of a new year-to-date high. A breach of this level would be seen as further evidence that an important uptrend is underway following the 8.6 year cycle low in July. The decline in NZD/JPY is alos quite interesting as it broke under the neckline of a multi-month head & shoulders pattern (daily closing basis) at .8575. The measured objective of the pattern is around .8200.

To receive Kristian’s analysis directly via email, pleaseSIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Price & Time: RBNZ A Seller

No comments:

Post a Comment