Talking Points

USD/CAD Technical Strategy: Longs Preferred

Absence of Reversal Signals May Open Further Gains

Sights Turn To 2014 High Following Breach Of 1.11

USD/CAD’s ascent has encountered some turbulence which may prove transitory with a void of bearish reversal signals in its wake. This keeps the 2014 high near 1.1270 in focus. A slide back under the 1.1100 barrier would be required to warn of a correction for the pair.

USD/CAD: Loses Steam After Leaping Over 1.1100 Hurdle

Daily Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

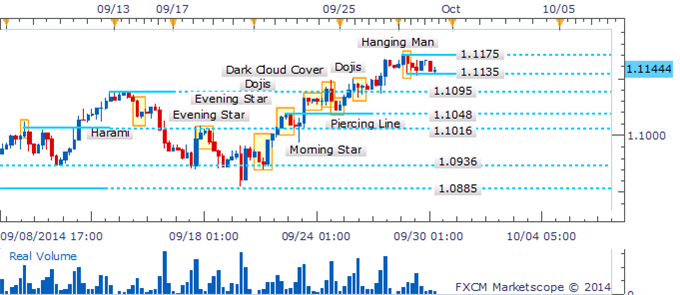

The four hour chart reveals some ‘messy’ intraday price action within the 1.1135 and 1.1175 trading band. While a Hanging Man had warned of a potential correction, it failed to find significant follow-through. This leaves a break of the recent range desired in order to offer a clearer directional bias.

USD/CAD: Awaiting Break From Intraday Congestion

4 Hour Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

USD/CAD Setback May Prove Short-Lived With Bearish Candles Missing

No comments:

Post a Comment