Talking Points

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD has fallen to its lowest level in two years this morning

Our near-term trend bias is lower while below 1.2705

A close under 1.2585 is needed to confirm that a more important leg lower in underway

A turn window of some important is eyed later next week

A close over 1.2705 would turn us positive on the euro

USD/JPY Strategy: Like holding reduced long short positions while below 1.2705.

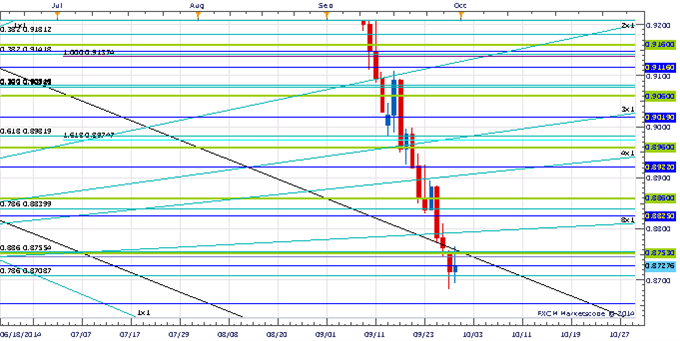

Price & Time Analysis: AUD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

AUD/USD fell to its lowest level since early January on Monday before finding support near the year’s closing low in the .8680 area

Our near-term trend bias is lower in the Aussie while below .8815

A close under .8680 is needed to set off the next important leg lower in the pair

A minor turn window is eyed later next week

A close over .8815 area would turn us positive on the Aussie

AUD/USD Strategy: Like the short side while below .8815

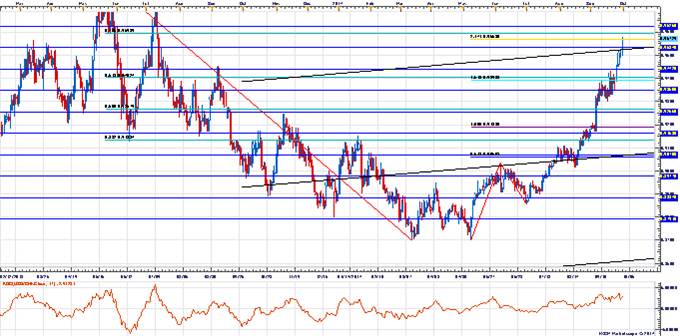

Focus Chart of the Day: USD/CHF

Timing methods, sentiment and even extreme overbought conditions have served of little use over the past few weeks in USD/CHF as the exchange rate has continued to power higher despite these caution flags. We believe that at some point these conditions will lead to some sort of snapback, but it is now a guess as to when. There is some timing over the next few days, but if recent reactions by other USD pairs are a guide the market will pay little attention to this cyclical resistance. Interesting price resistance is eyed between .9600 and .9625 as this marks a convergence of the 78.6% retracement of the 2013-2014 decline and the 10th square root relationship of the year’s low, but only a clear failure price action wise would warrant going counter trend. Over .9625 exposes Fibonacci resistance near .9700.

To receive Kristian’s analysis directly via email, pleaseSIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Price & Time: King Dollar

No comments:

Post a Comment