Talking Points

USD/JPY Technical Strategy: Longs preferred

Bearish reversal signal emerges following test of 104.00

Dip back to 103.50 to offer new long opportunities

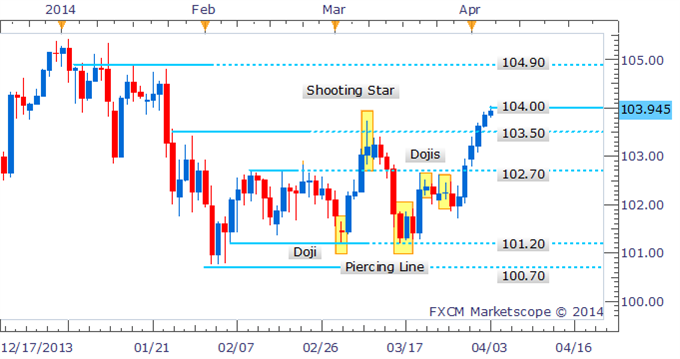

The USD/JPY bulls have halted their charge at the psychologically-significant 104.00 handle. While a bearish reversal signal is lacking on the daily, intraday price action suggests the potential for a dip. A correction back to prior resistance at 103.50 would be seen as an opportunity to enter new long positions.

USD/JPY: 104.00 Prompts Bulls To Pause

Daily Chart – Created Using FXCM Marketscope 2.0

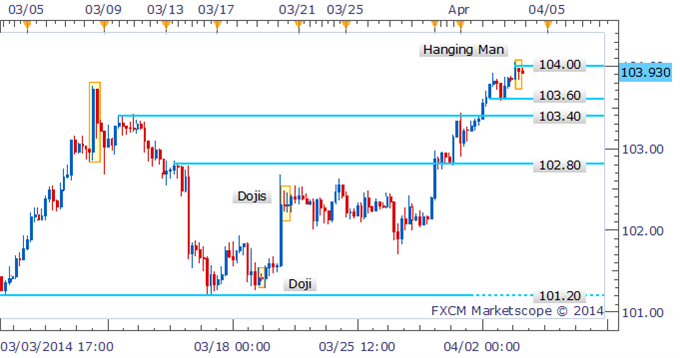

Drilling down to the four hour chart; a test of the 104.00 handle in Asian trading has prompted the formation of a Hanging Man candlestick, which offers an ominous warning. However, the bearish reversal signal awaits confirmation from a successive down period, which if received, would likely prompt a dip back to 103.60

USD/JPY: Hanging Man Near Key Resistance Offers Warning

Four Hour Chart – Created Using FXCM Marketscope 2.0

By David de Ferranti, Market Analyst, FXCM

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Forex Strategy: USD/JPY Hanging Man Emerges After Test of 104.00

No comments:

Post a Comment