Talking Points

GBP/USD top in place or consolidating before another run higher?

USD/JPY threatening key break

Gold remains under pressure

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/JPY has moved steadily higher over the past few days to test the 2nd square root realtionship of the year’s high at 103.40

Our near-term trend bias is higher in the exchange rate while over 101.35

The 3rd square root relationship of the year’s low at 103.75 is critical near-term resistance with traction over this level needed to signal that the rate has broken out of its multi-month consolidation

A very minor cycle turn window is seen today

Interim support is eyed at 102.35, but only a move under 101.35 would turn us negative

USD/JPY Strategy: We like the long side while over 101.35.

Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

XAU/USD has come under further pressure on Tuesday to trade at its lowest level since early February

Our near-term trend bias is lower in Gold while below 1336

The 50% retracement of the December/March advance at 1285 is key support with a daily close below opening the way for a much deeper decline

An important cycle turn window is seen starting around the end of the week and extending into the middle of next week

A move back over 1336 would turn us positive again on the metal

XAU/USD Strategy: We like the short side while below 1336.

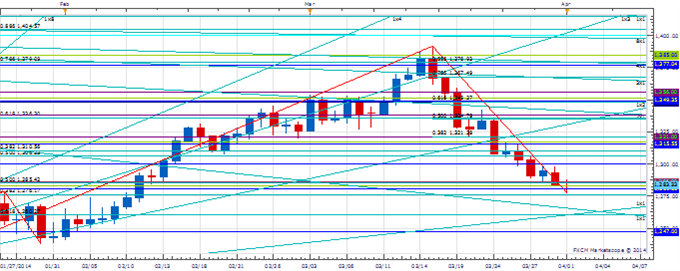

Focus Chart of the Day: GBP/USD

The move lower we have been looking for in GBP/USD has so far proven elusive. Monday’s high, however, did come around the 1.6685 61.8% retracement of the mid-February/March range and there is a chance that it marks some sort of secondary top in the exchange rate. The next few hours are critical. Follow on weakness below 1.6600 is now needed to confirm a reversal and set the stage for a stronger move lower in the days ahead. With the cyclical turn period we highlighted last week ending yesterday, any strength back through 1.6685 by more than a few pips would completely negate the potential negative cyclicality that we see at work and re-focus attention higher.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Price & Time: GBP/USD What Now?

No comments:

Post a Comment