Talking Points

EUR/USD holds key support level

Kiwi rebounds from key Gann level

ATR in FXCM Dollar Index touches 12-year low

New to Currency Trading? Learn More HERE

forex technical analysis,forex analysis,forex trading strategies,forex signals,forex strategies,forex strategy, forex trading

Foreign Exchange Price & Time at a Glance:

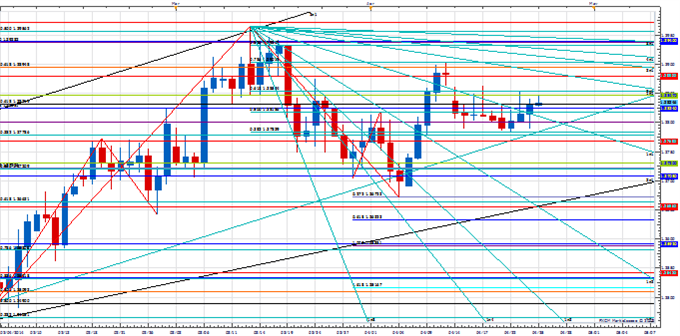

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD remains in a sideways to lower range since reversing earlier this month at the 78.6% retracement of the March to April decline near 1.3900

Our near-term trend bias is positive in the Euro while over 1.3730

A move through 1.3900 is needed to confirm that a new move higher is underway

A minor cycle turn window is seen around the middle of next week

Only a move under 1.3730 would turn us negative on the Euro

EUR/USD Strategy: Like the long side while over 1.3730.

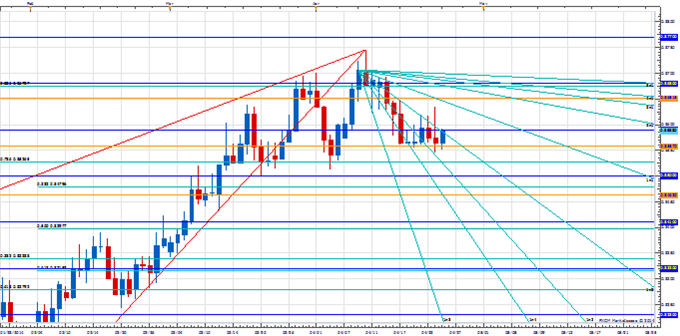

Price & Time Analysis: NZD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

NZD/USD has come under steady pressure since reversing earlier in the month near .8750

Our near-term trend bias remains higher in the Bird while over the 2nd square root relationship of the year’s high at .8555

A convergence of Gann levels near .8640/50 is key resistance that needs to be overcome to signal that the rate is resuming higher

A cycle turn window is seen later next week

A daily close under .8555 will turn us negative on the Kiwi

NZD/USD Strategy: Like the long side while over .8555.

Focus Chart of the Day: FXCM DOLLAR INDEX

The extreme narrow ranges in the main exchange rates is making cyclical analysis a bit more difficult to say the least. The FXCM Dollar Index typifies this compression in volatility as the three week Average True Range (ATR) in the instrument is now at its lowest level since 2002. The broader cycles seem to favor general weakness in the Greenback into the start of next month as an important turn window is seen around this time, but admittedly our conviction is low. Key support is eyed around 10,440 and a break of this level is needed to confirm that a decline is underway, but under 10,400 is really required to spark something more significant on the downside. Traction over 10,510 is needed to re-focus higher.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Price & Time: Stability Begets Instability

No comments:

Post a Comment