Talking Points

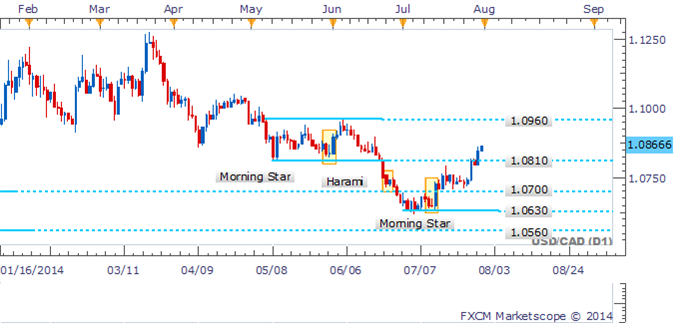

USD/CAD Technical Strategy: Longs Preferred

Absence of key reversal patterns suggests gains to continue

Break Of 1.0810 Paves The Way For Run On 1.0960

USD/CADcould maintain its upward trajectory following a Morning Star formation on the daily and absence of bearish reversal candlesticks. Following the clearance of the 1.0810 mark the June highs near 1.0960 look attainable.

Traders should note that a string of top-tier US data over the session ahead may spark significant volatility that voids some of the technical signals offered.

USD/CAD: Upside Break Opens 1.0960 With Bearish Patterns Absent

Daily Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

A similar narrative to the daily is evident on the four hour timeframe with bearish candlesticks lacking. This casts doubt on a potential correction for the pair over the session ahead. Further gains may be in store on a push above intraday resistance at 1.0870.

USD/CAD: Eyeing Further Gains With Bearish Signals Lacking

4 Hour Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

By David de Ferranti, Market Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

USD/CAD Eyeing 1.0960 Following Morning Star Formation

No comments:

Post a Comment