To receive Ilya’s analysis directly via email, please SIGN UP HERE

Talking Points:

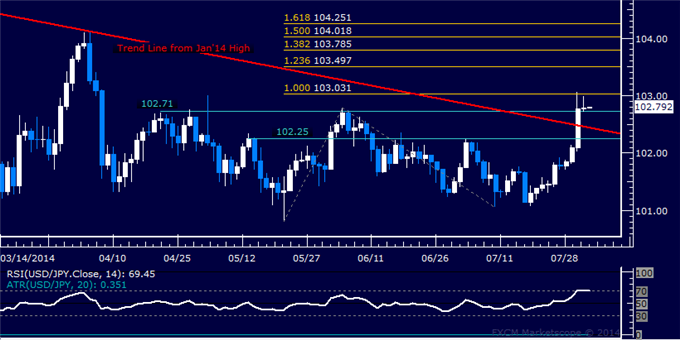

USD/JPY Technical Strategy: Flat

Support: 102.71, 102.43, 102.25

Resistance: 103.03, 103.50, 103.79

The US Dollar appears to have forced a major turning point against the Japanese Yen after breaking above resistance limiting the upside since January. Near-term resistance is at 103.03, the 100%Fibonacci expansion, with a daily close above that exposing the 123.6% level at 103.50. Alternatively, a turn below resistance-turned-support marked by the April 22 high at 102.71 clears the way for a challenge of the broken trend line, now at 102.43.

Prices are wedged too closely between near-term support and resistance levels to justify entering a trade on the long or short side from a risk/reward perspective. We will continue to stand aside for now, waiting for an actionable opportunity to present itself.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

Daily Chart – Created Using FXCM Marketscope 2.0

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

USD/JPY Technical Analysis: Upswing Stalls at 103.00 Figure

No comments:

Post a Comment