Talking Points

USD/JPY Technical Strategy: Sidelines Preferred

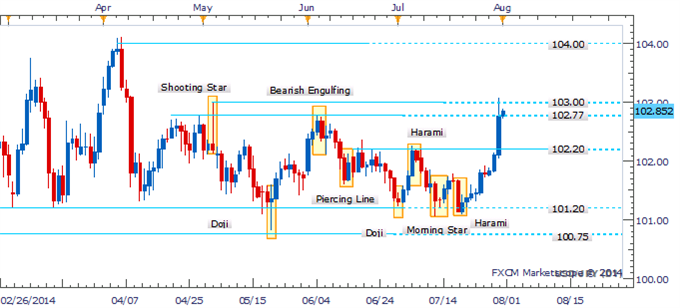

Failure To Breach 103.00 Casts Doubt On Gains

Awaiting Bearish Patterns To Signal A Reversal

USD/JPY has continued its ascent following a Harami pattern on the daily with the pair testing key resistance near 103.00 in recent trading. The failure to breach the psychologically-significant barrier casts some doubt on further gains. However, an absence of bearish patterns also makes a reversal questionable. This leaves the sidelines preferred until a more constructive setup presents itself.

USD/JPY: Hits Selling Pressure Yet Reversal Signals Lacking

Daily Chart – Created Using FXCM Marketscope 2.0, Volume Indicator Available Here

The four hour chart reveals a similar narrative as the daily. A Harami pattern has failed to find follow-through which has left a void of reversal patterns. Several Doji formations indicate noteworthy indecision amongst traders near the 103.00 handle.

USD/JPY: Dojis Suggest Bulls Lose Steam Near 103.00 Handle

Four Hour Chart – Created Using FXCM Marketscope 2.0,Volume Indicator Available Here

By David de Ferranti, Currency Analyst, DailyFX

Follow David on Twitter: @Davidde

To receive David’s analysis directly via email, please sign up here.

Learn how to read candlesticks to help identify trading opportunities with the DailyFX Candlesticks Video Course.

USD/JPY Hits Selling Pressure At 103.00 Yet Reversal Patterns Lacking

No comments:

Post a Comment