Talking Points:

US Dollar Poised to Renew Advance After Pullback

S&P 500 Resumes Reversal, Touches Two-Week Low

Gold Hits 4-Month High But Gains May Be Fleeting

Can’t access the Dow Jones FXCM US Dollar Index? Try the USD basket on Mirror Trader. **

US DOLLAR TECHNICAL ANALYSIS – Prices rebounded as expected after putting in a Bullish Engulfing candle pattern at support set from October 2013. A shallow pullback looks corrective in the context of the upside breakout that cleared resistance at the top of a falling channel set from early June. A daily close above resistance at 10431, the 38.2% Fibonacci retracement, targets the 50% level at 10452. Alternatively, a turn back below channel top resistance-turned-support at 10388 exposes a triple bottom in the 10354-75 area.

Daily Chart – Created Using FXCM Marketscope 2.0

** The Dow Jones FXCM US Dollar Index and the Mirror Trader USD basket are not the same product.

S&P 500 TECHNICAL ANALYSIS – Prices fell as expected after putting in a bearish Evening Star candlestick pattern at the top of a rising channel set from mid-April. A break below the 14.6% Fibonacci retracement at 1960.10 on a daily closing basis exposes the 23.6% level at 1944.20, a barrier reinforced by a rising channel floor set from mid-April. Near-term trend line support-turned-resistance is at 1989.10, followed by the July 3 highat 1985.90.

Daily Chart – Created Using FXCM Marketscope 2.0

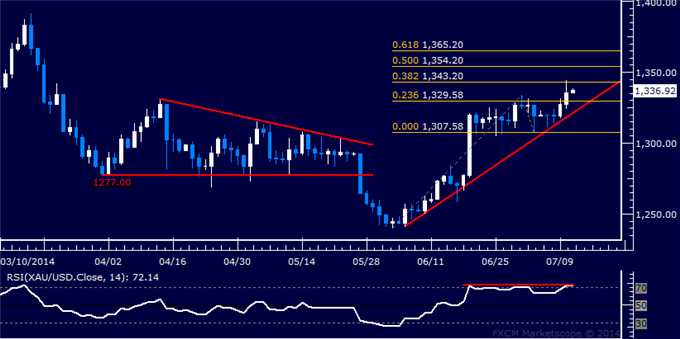

GOLD TECHNICAL ANALYSIS – Prices broke upward out of a consolidation range, with buyers now testing resistance marked by the 38.2% Fibonacci expansion at 1343.20. A break above this barrier on a daily closing basis exposes the 50% level at 1354.20. Negative RSI divergence warns of ebbing bullish momentum however and hints a reversal lower may be ahead. A reversal below the 23.6% Fib at 1329.58 aims for a rising trend line set from early June, now at 1321.96.

Daily Chart – Created Using FXCM Marketscope 2.0

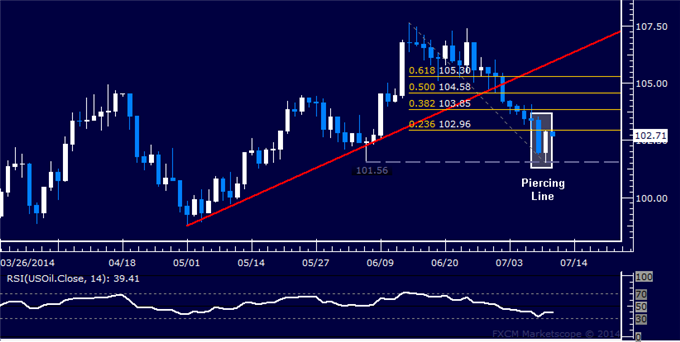

CRUDE OIL TECHNICAL ANALYSIS – Prices may be carving out a double bottom after showing a bullish Piercing Line candlestick pattern above support at 101.56, the June 5 swing low. Near-term resistance is at 102.96, the 23.6% Fibonacci retracement, with a break above that on a daily closing basis exposing the 38.2% level at 103.85. Alternatively, a reversal below support initially targets the 100.00 figure.

Daily Chart – Created Using FXCM Marketscope 2.0

— Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya’s analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

Gold Jumps to Four-Month High Upward Momentum May Be Fleeting

No comments:

Post a Comment